VERTICAL INTEGRATION AND

TECHNOLOGY: THEORY AND EVIDENCE

Daron Acemoglu

Massachusetts Institute of Technology

Rachel Griffith

University College London

Philippe Aghion

Harvard University

Fabrizio Zilibotti

University of Zurich

Abstract

We study the determinants of vertical integration. We first derive a number of predictions

regarding the relationship between technology intensity and vertical integration from a simple

incomplete contracts model. Then, we investigate these predictions using plant-level data for the

UK manufacturing sector. Most importantly, and consistent with the theoretical predictions, we

find that the technology intensity of downstream (producer) industries is positively correlated

with the likelihood of integration whereas the intensity of upstream (supplier) industries is

negatively correlated with it. Also consistent with theory, both correlations are stronger when

the supplying industry accounts for a large fraction of the producer’s costs. These results are

generally robust and hold with alternative measures of technology intensity, with alternative

estimation strategies, and with or without controlling for a number of firm- and industry-level

characteristics. (JEL: L22, L23, L24, L60)

1. Introduction

Despite a large theoretical literature on the determinants of vertical integration,

the economics profession is far from a consensus on the empirical determinants of

vertical integration in general, and the relationship between technological change

The editor in charge of this paper was Xavier Vives.

Acknowledgments: We thank Richard Blundell, Robert Gertner, Oliver Hart, Bengt Holmstrom,

Ali Hortaçsu, Paul Joskow, Ariel Pakes, Helen Simpson, Helena Svaleryd, John Van Reenen, and sem-

inar participants at Canadian Institute of Advanced Research, Chicago, Harvard, IIES-Stockholm,

MIT and NBER, and the CEPR-IUI Waxholms Conference. This work contains statistical data from

ONS which is Crown Copyright and is reproduced with the permission of the controller of HMSO.

The use of the ONS statistical data in this work does not imply the endorsement of the ONS in rela-

tion to the interpretation or analysis of the statistical data. Griffith acknowledges financial support

from the Economic and Social Research Council (ESRC), and Zilibotti acknowledges the support

of the European Research Council (ERC Advanced Grant IPCDP-229883) and the Swiss National

Science Foundation (SNF Grant 100014-122636).

Journal of the European Economic Association September 2010 8(5):989–1033

© 2010 by the European Economic Association

990 Journal of the European Economic Association

and vertical integration in particular.

1

This paper provides a simple incomplete

contracts model of vertical integration and, in the light of the predictions of

this model, presents detailed empirical evidence on the determinants of vertical

integration using UK firm-level data over the period 1996–2001.

The two leading theories of vertical integration are the Transaction Cost

Economics (TCE) approach of Williamson (1975, 1985) and the Property Right

Theory (PRT) approach of Grossman and Hart (1986) and Hart and Moore

(1990).

2

Both approaches emphasize the importance of incomplete contracts and

ex post opportunistic behavior (hold up) on ex ante relationship-specific invest-

ments. The TCE approach views vertical integration as a way of circumventing

the potential holdup problems. In particular, it predicts that vertical integration

should be more common when there is greater specificity and holdup is more

costly, and that vertical integration should enhance investments by all contracting

parties. The PRT approach, on the other hand, focuses on the role of ownership

of assets as a way of allocating residual rights of control, and emphasizes both

the costs and the benefits of vertical integration in terms of ex ante investment

incentives.

To illustrate the central insight of the PRT, consider a relationship between

a supplier (upstream firm) and a (downstream) producer. Moreover, suppose that

only two organizational forms are possible: (backward) vertical integration, where

the downstream producer buys up the upstream supplier and has residual rights of

control, and non-integration (outsourcing), where the producer and supplier are

separate firms. In this world, vertical integration does not automatically improve

efficiency. Instead, by allocating the residual rights of control to the producer, who

has ownership and thus control of the assets if there is a breakup of the relationship,

vertical integration increases the producer’s bargaining power and encourages its

investment. However, by the same mechanism, it also reduces the supplier’s ex

post bargaining power and hence her incentives to invest. Non-integration, on the

other hand, gives greater investment incentives to the supplier. Thus, in contrast to

the TCE approach, the PRT predicts that vertical integration should have opposite

effects on the supplier’s and the producer’s investments. Here, vertical integration

has both costs and benefits in terms of ex ante investments, and its net benefits

1. We discuss the empirical literature herein. On the theory side, see, among others, Williamson

(1975, 1985), Klein, Crawford, and Alchian (1978), Grossman and Hart (1986), Hart and Moore

(1990), Bolton and Whinston (1993), Aghion and Tirole (1994a, 1994b, and 1997), and Legros and

Newman (2008), together with the surveys in Holmstrom and Tirole (1989) and Hart (1995). Papers

on the potential impact of technology on vertical integration include, among others, Milgrom and

Roberts (1990), Helper (1991), Athey and Schmutzler (1995), Bresnahan, Brynjolfsson, and Hitt

(2002), Marin and Verdier (2003a, 2003b), Acemoglu, Aghion, and Zilibotti (2003), and Acemoglu

et al. (2007). See also the literature on international trade and vertical integration (or outsourcing),

for example, Feenstra and Hanson (1996, 1999), Feenstra (1998), McLaren (2000), Grossman and

Helpman (2002, 2005), and Antras (2003).

2. See Whinston (2001) and Joskow (2005) for recent discussions.

Acemoglu et al. Vertical Integration 991

depend on whether the investments of the producer or those of the supplier are

more important for the output and success of the joint venture.

Although the key predictions of the TCE approach could be tested by

investigating the relationship between measures of specificity and vertical inte-

gration, as Whinston (2001) also emphasizes, the PRT approach is more difficult

to test directly because it makes no predictions about the overall relationship

between specificity and vertical integration or between vertical integration and

total investment. However, crucially for our paper, one can test some of its dis-

tinctive predictions, for example that vertical integration has opposite effects on

investments by the two contracting parties.

In this paper, we develop a simple methodology to study the forces empha-

sized by the PRT approach. First, we shift the focus from relationship-specific

investments to technology intensity. The presumption is that parties making tech-

nology investments, especially in R&D, are subject to holdup, and this will lead

to the type of problems highlighted by the TCE and PRT approaches.

3

Second, we

consider the relationship between pairs of supplying and producing industries and

focus on the prediction that the correlations between vertical integration and the

investment incentives of suppliers and producers should display opposite signs.

Our approach therefore exploits cross-industry (cross-product) implications of

the PRT.

We first develop these points using a simple theoretical framework and derive

a number of predictions that are testable with the data we have available. The

framework highlights that backward vertical integration gives greater investment

incentives to the producer, while forward vertical integration encourages supplier

investment. Non-integration provides intermediate incentives to both parties. This

analysis leads to three key predictions:

1. The importance of the technology intensity of the producer and supplier

should have opposite effects on the likelihood of vertical integration. In par-

ticular, whereas a higher importance of the producer’s technology intensity

should increase the probability of backward integration, a higher importance

of the supplier’s technology intensity should reduce that probability.

2. Vertical integration should be more responsive to the technology intensities

of both the supplier and the producer when the supplier accounts for a larger

fraction of the input costs of the producer.

3. If the relevant margin of choice is between backward vertical integration and

non-integration, then technology intensity of the supplier should discourage

3. This could be for a variety of reasons. First, R&D investments are often made for technologies

specific to each firm (or their mix of products). Second, associated with any technological investment,

parties are also likely to make specific, non-tangible, and largely unverifiable innovative investments.

Finally, market imperfections, for example search frictions, typically turn “technologically general”

investments into specific investments (e.g., Acemoglu 1996; Acemoglu and Pischke 1999).

992 Journal of the European Economic Association

integration, the technology intensity of the producer should encourage inte-

gration, and the importance of the supplier to the producer (measured in terms

of share of costs) should encourage integration.

We investigate these predictions, and other determinants of vertical inte-

gration, using detailed data on all British manufacturing plants from the UK

Census of Production (ARD). To identify the effects of both supplier and pro-

ducer technology, we look across all manufacturing industries. To measure the

extent of vertical integration and to develop an empirical strategy to document the

determinants of integration, we need to take a stance as to whether backward or

forward vertical integration is the most important alternative to non-integration.

Motivated by the bulk of the prior empirical work (e.g., Joskow 1987, 2005;

Stuckey 1983), we focus on backward vertical integration.

4

Using this data set

and the UK Input–Output Table, we calculate two measures of (backward) ver-

tical integration, defined at the level of firm–industry-pair (more precisely, for

firm i producing product j with input from industry k).

5

The first measure is a

dummy variable indicating whether the firm owns a plant producing input k nec-

essary for product j . The second measure calculates how much of the inputs from

industry k, necessary for the production of j , the firm can produce in-house. It is

useful to emphasize that what we uncover are correlations, not necessarily causal

relations.

Using the ratio of R&D expenditures to value added (calculated from a sample

pre-dating our vertical integration measures), we find the following correlations

in the data:

• Consistent with prediction 1, technology (R&D) intensities of the producing

(downstream) and supplying (upstream) industries have opposite effects on

the likelihood of vertical integration. In particular, backward vertical inte-

gration is more likely (relative to non-integration) the greater the technology

intensity of the producer and the lower the technology intensity of the supplier.

• Consistent with prediction 2, the correlations between vertical integration and

the technology intensities of both the producing and the supplying industry

are substantially larger and also more significant when the share of costs of

the supplying industry in the total costs of the producing industry (for short,

“share of costs”) is high.

• Consistent with prediction 3 (provided that the relevant margin is between

backward vertical integration and non-integration), we also find that

4. This is also the strategy implicitly adopted in other cross-industry studies of vertical integration;

see, for example, Antras (2003).

5. Note that these measures do not distinguish between backward or forward integration, because

we do not observe who has residual rights of control. Nevertheless, conceptually they are closer to

measures of backward integration, since the question is whether firm i is integrated with its upstream

suppliers (rather than firm j being integrated with downstream producers potentially using its inputs).

Acemoglu et al. Vertical Integration 993

technology intensity of the producing industry is associated with more vertical

integration, technology intensity in the supplying industry is associated with

less integration, and the share of costs is associated with more integration.

We subject these basic patterns in the data to a series of robustness checks.

The results are generally robust. First, including a range of firm-level covariates

does not change the relationship between R&D intensity and vertical integration.

Second, the results are broadly similar when we restrict attention to multiplant

firms and control for firm level fixed effects.

6

Third, the results are similar when

we proxy for technology intensity by physical investments rather than R&D.

Fourth, the results are robust to excluding top or bottom quartiles of firms by size

and to using an alternative measure of vertical integration. Finally, the results

are also similar when we use a probit model rather than a linear probability

model.

We also investigate the relationship between competition (measured as the

number of firms in supplying and producing industries) and vertical integration.

Our results here are also consistent with theory and indicate that having more firms

in the supplying industry reduces the likelihood of vertical integration, while a

larger number of firms in the producing industry increases it.

In our regressions, a measure of vertical integration is on the left-hand side,

and industry and firm characteristics are on the right-hand side. However, in

theory, and most likely in practice, vertical integration also affects technology

choices. Moreover, other factors omitted in the regression could influence both

vertical integration and technology intensity, and in a cross-industry regression

there are many potential omitted variables. Although our fixed effects regressions

control for many such omitted characteristics, there is still a concern regarding

causality. As an imperfect attempt at dealing with the endogeneity problem, we

report results where the technology intensity of each industry is instrumented

with the technology intensity of the same industry in the United States. This

instrumentation strategy generally yields results similar to, and in fact quanti-

tatively larger than, the ordinary least squares strategy.

7

Overall, we conclude

that there is an interesting pattern in the data, with technology intensity of pro-

ducing and supplying industries having opposite effects on the likelihood of

vertical integration. This pattern should be important in evaluating the predic-

tions of a range of different theories of vertical integration (even though we have

6. In particular, with firm fixed effects, even though the main effect of producer R&D intensity

is no longer statistically significant, both supplier R&D intensity and the interaction between both

supplier and producer R&D intensities and share of costs remain significant. When we control for

endogenous selection, the effect of producer R&D intensity is again statistically significant.

7. However, when we simultaneously instrument for the main effects and the interaction terms, the

results are imprecisely estimated.

994 Journal of the European Economic Association

motivated our empirical approach from a specific theory based on incomplete

contracts).

8

In addition to the theoretical studies mentioned earlier, this paper is related

to a large empirical literature on vertical integration. In contrast to our approach,

most empirical studies of vertical integration are motivated by the TCE approach

and focus on a single industry. These include Joskow’s (1987) seminal paper

on ownership arrangements in electricity generating plants, Stuckey’s (1983)

study of integration between aluminium refineries and bauxite mines, Monteverde

and Teece’s (1982) investigation of integration in the automobile industry, Mas-

ten’s (1984) work on the aerospace industry, Ohanian’s (1994) work on the pulp

and paper industry, and Klein’s (1998) work on the Fisher Body and General

Motors relationship. More recently, important papers by Baker and Hubbard

(2003, 2004) study the trucking industry, Lerner and Merges (1998) consider

the biotech sector, Woodruff (2002) studies integration in the Mexican footwear

industry, Chipty (2001) investigates vertical integration and market foreclosure

in the cable television industry, and Hortaçsu and Syverson (2007) study vertical

integration in the U.S. cement industry. The only cross-industry evidence relevant

to our investigation of which we are aware is due to Caves and Bradburd (1988),

who document a positive cross-industry correlation between measures of speci-

ficity and vertical integration, and from Antras (2003), who looks at the share of

intra-firm imports over total imports for 23 U.S. industries and relates this to cap-

ital intensity. We are not aware of any other papers investigating the prediction

that the technology intensity of suppliers and producers have opposite effects

on vertical integration decisions (see Lafontaine and Slade (2007) for a recent

survey).

The paper is organized as follows. Section 2 presents the theoretical

framework and derives the main testable implications. Section 3 details the con-

struction of our measure of vertical integration, and also discusses data sources

and the construction of the other key variables. Section 4 presents the main

results. Section 5 discusses robustness checks and additional tests. Section 6

briefly investigates the effect of competition in producing and supplying indus-

tries on vertical integration. Finally, Section 7 discusses alternative theoretical

approaches that may account for the correlations presented in this paper and

then concludes.

8. Our proxies for technological intensity may be correlated with the relevant demand elasticities

and impact vertical integration decision through strategic considerations, though it is unclear why

this could generate the opposite-signed patterns that we find robustly in the data.

More generally, although the specific regressions estimated in this paper are motivated by the

PRT approach, the results are informative about, and could be consistent with, other approaches to

vertical integration. In the concluding section, we discuss how these results could be reconciled with

other theories.

Acemoglu et al. Vertical Integration 995

2. Theory and Empirical Hypotheses

In this section, we construct a simple theory of the determinants of vertical inte-

gration in the spirit of Grossman and Hart (1986). The focus is on the relative

importance of technological investments in a bilateral relationship between a pro-

ducer and a supplier. In the model, the two parties can either remain as separate

entities (non-integration, NI), or the producer can employ the supplier and become

the residual claimant of the profits generated by the joint venture (backward ver-

tical integration, VIB), or the supplier can employ the producer and become the

residual claimant (forward vertical integration, VIF). As already discussed in the

Introduction, when we turn to data we will focus on backward vertical integra-

tion. Nevertheless, it is useful to understand the implications of the theoretical

framework both for backward and forward integration.

2.1. Model Environment

We consider a one-period relationship between two risk-neutral parties who can

undertake technological investments to increase the productivity of the rela-

tionship. Throughout, we assume these investment decisions to have a specific

component in that greater technology intensity leads to a greater possibility of

holdup. Decision rights over these investments cannot be transferred between

the two parties, for example, because the investments require tacit knowledge

or human capital. This implies that the producer cannot make the supplier’s

investments, or vice versa. As is standard in this literature, we assume that the

investments and the output of the relationship are non-verifiable. Consequently,

neither contracts conditional on investments nor contracts specifying rules for

ex post revenue-sharing are possible. However, the allocation of property rights

(vertical integration or arms’ length) can be designed so as to provide the right

incentives for the non-contractible investments.

We adopt the usual timing assumptions: Before investments and production

take place, the parties can choose an organizational form and transfers. We denote

the amount of ex ante transfer to party i conditional on the organizational form z

by T

i

(z), where P and S denote the producer and the supplier, respectively. More

formally, the timing of events in this relationship is as follows:

1. The producer offers an organizational form (ownership structure) z ∈

{VIB, NI, VIF} and associated transfers, T

P

(z) and T

S

(z), such that T

P

(z) +

T

S

(z) = 0. There are no credit constraints, implying that T

i

(z) can be

negative.

2. The supplier decides whether to accept or reject the offer. If the offer is not

accepted, then the two parties remain independent, and the producer does

not receive any specific input from the supplier (in this case, the game ends

996 Journal of the European Economic Association

with payoffs {O

NI

P

,O

NI

S

} defined subsequently). Then, the producer and the

supplier simultaneously choose their investments, e

P

≥ 0 and e

S

≥ 0.

3. The supplier and the producer bargain over the division of the revenue, accord-

ing to the Nash bargaining solution given the organizational form z. Output

is realized and shared.

9

The production technology of the relationship is

F(x

S

,e

P

,e

S

) = ϕx

S

(pe

P

+ se

S

+ 1) + (1 − ϕ)(pe

P

+ 1). (1)

The first term in equation (1) is the output generated by the producer and the sup-

plier conditional on the supplier providing a customized (relationship-specific)

input, denoted x

S

= 1. If x

S

= 0 and this input is not supplied, these activi-

ties generate no revenue. The value of the relationship can be further increased

by the producer’s and the supplier’s investments, e

P

and e

S

. The parameters p

and s designate the relative importance of investments by the producer and the

supplier, that is, the extent to which one type of investment brings more value

added than the other, and ϕ ∈ (0, 1) corresponds to the share of the producer’s

inputs accounted for by the supplier.

10

Note that ϕ also determines the importance

of the supplier’s investment, e

S

.

11

This production function has also normalized

the level of output in the absence of any investments to 1, which is without

any loss of generality. The feature that there are no complementarities between

the investments of the supplier and the producer is for simplicity, and high-

lights the fact that, for the results we emphasize, such complementarities are not

essential.

To simplify the expressions, we assume that the supplier can provide the

basic input x

S

at no cost, and also that the costs of investment for both parties are

quadratic:

P

(e

P

) =

1

2

e

2

P

and

S

(e

S

) =

1

2

ϕe

2

S

. (2)

9. In this game form, the assumptions that the producer makes the organizational form offer and

that the parties receive their non-integration outside options are without loss of any generality.

Moreover, following other papers in this literature, we are using the Nash bargaining solution (see

Binmore, Rubinstein, and Wolinsky (1986) for a potential justification for Nash bargaining and

a discussion of alternative bargaining rules), but our qualitative results do not depend on Nash

bargaining.

10. With competitive spot market transactions and without any specific investments, namely, e

P

=

e

S

= 0, ϕ would exactly correspond to the share of costs of the producer accounted for by the

supplier in question. Although with positive investments and ex post bargaining, there will be a

wedge between the two, we refer to ϕ as the “share of costs” to simplify the terminology.

11. Symmetrically, we could introduce another parameter, say η, to capture the importance of the

producer for the supplier. Comparative statics with respect to η are very similar to those with respect

to ϕ. We omit this generalization to reduce notation, and discuss empirical results regarding the

effect of a measure related to η in Section 5.

Acemoglu et al. Vertical Integration 997

Notice that the investment costs of the supplier are multiplied by ϕ. This ensures

that the costs are proportional to the scale of operation and that the socially optimal

levels of both e

P

and e

S

are independent of ϕ.

12

In the event of disagreement, the two parties receive their outside options,

which depend on the organizational form. We denote the outside option of party

i under organizational form z by O

z

i

.

With backward vertical integration (VIB), the producer owns all assets, and in

the event of ex post breakup the supplier simply walks away from the firm without

receiving anything.

13

The producer, who has residual control rights, keeps all the

assets and the customized input, but lack of cooperation from the supplier causes

the loss of a fraction λ of the supplier’s investment, so the “effective investment”

of the supplier is reduced to (1 −λ)e

S

where λ ∈[0, 1).

14

Therefore, the outside

options of the supplier and the producer in this case are

O

VIB

S

(e

P

,e

S

) = 0 and O

VIB

P

(e

P

,e

S

) = F(x

S

= 1,e

P

,(1 − λ)e

S

).

With non-integration (NI), the supplier and the producer own their separate

firms and assets. In case of disagreement, the producer does not receive the cus-

tomized input from the supplier (x

S

= 0), and consequently, generates no output

from the part of the operations relying on those inputs. The supplier can sell

her input in the market, but suffers in this case some revenue loss because of

the specificity of the input to this producer. Therefore, the outside options under

non-integration are

O

NI

S

(e

P

,e

S

) = θϕ(se

S

+ 1),

O

NI

P

(e

P

,e

S

) = F(x

S

= 0,e

P

,e

S

) = (1 − ϕ)(pe

P

+ 1), (3)

where θ ∈[0, 1) is an inverse measure of how much the supplier loses if she

sells the input outside of the specific relationship.

15

The general equilibrium

12. The socially optimal levels of investment are e

P

= p and e

S

= s. Modifying the supplier’s

cost function to

S

(e

S

) = e

2

S

/2 would introduce an implicit “scale economies,” and an increase in ϕ

would make the supplier’s investment more profitable (the socially optimal level of investment for

the supplier would become e

S

= sϕ). Consequently, the comparative static results with respect to ϕ

become ambiguous.

13. More generally, our analysis goes through if we assume that in case of ex post break-up the sup-

plier receives a positive fraction of what she would receive under non-integration, and symmetrically

for the producer under forward integration.

14. Alternatively, λ can be interpreted as the fraction of investment which is incurred at the end of

the period by the supplier to fine-tune the quality of the input. The supplier would not undertake this

investment in the event of disagreement.

15. It is possible to also allow a secondary market in which the producer can purchase a less suitable

input, in which case his outside option would be:

O

NI

P

(e

P

,e

S

) = (1 − ϕ)(pe

P

+ 1) + ρϕ(pe

P

+ 1),

where ρ + θ<1. This modification has no effect on the results.

998 Journal of the European Economic Association

determination of θ is beyond the scope of our paper. Here it is treated as exogenous

and in the empirical section it is proxied by the relative number of producers to

suppliers (with more producers, it might be easier for the supplier to find a suitable

buyer to her input in the secondary market).

The third organizational form is forward vertical integration (VIF), where the

supplier owns all the assets. In this case, with a similar reasoning as before, the

outside options are

O

VIF

S

(e

P

,e

S

) = F(x

S

= 1,(1 − λ

)e

P

,e

S

) and O

VIF

P

(e

P

,e

S

) = 0,

where λ

∈[0, 1) is the fraction of the producer’s investment the supplier loses

in case of disagreement.

Let y

z

i

denote the output accruing to party i under organizational form z.

Symmetric Nash bargaining implies that

y

z

i

(e

P

,e

S

) = O

z

i

(e

P

,e

S

) +

1

2

F(x

S

= 1,e

P

,e

S

) − O

z

P

(e

P

,e

S

) − O

z

S

(e

P

,e

S

)

,

(4)

where the term in square brackets is the relationship-specific surplus over which

bargaining takes place, and is positive for all z ∈{VIB, NI, VIF}. The important

feature is that each party’s share of revenue will be increasing in her own outside

option, and decreasing in that of the other party. This feature creates a link between

outside options and investment incentives, and through this channel, between

organizational forms and investment incentives.

Finally, the utility of party i ∈{P,S} can be expressed as

U

z

i

(y

i

(e

P

,e

S

), e

i

) = y

z

i

(e

P

,e

S

) −

i

(e

i

) + T

i

(z). (5)

2.2. Equilibrium

We next characterize the unique (subgame perfect) equilibrium of the game

specified in the previous section. Unless otherwise specified, we refer to

an equilibrium by the on-the-equilibrium-path actions and revenues, (z

∗

,T

∗

P

,

T

∗

S

,e

∗

P

,e

∗

S

,y

∗

P

,y

∗

S

).

It is useful to define the “total surplus” of the relationship as

S

z

= U

z

S

y

z

S

e

∗

P

(z), e

∗

S

(z)

,e

∗

S

(z)

+ U

z

P

y

z

P

e

∗

P

(z), e

∗

S

(z)

,e

∗

P

(z)

,

where e

∗

i

(z) denotes party i’s optimal investment under ownership structure z,

using equations (4) and (5) and the fact that T

S

(z) +T

P

(z) = 0, we find the total

surplus of the relationship is

S

z

= F

x

S

= 1,e

∗

P

(z), e

∗

S

(z)

−

P

e

∗

P

(z)

−

S

e

∗

S

(z)

. (6)

Acemoglu et al. Vertical Integration 999

Because both parties have access to perfect credit markets and ex ante trans-

fers, the subgame perfect equilibrium will always pick the organizational form that

maximizes the surplus, S.

16

In other words, S

z

∗

≥ S

z

for all z ∈{VIB, NI, VIF}.

17

We now characterize the equilibrium by calculating the levels of social surplus

under backward integration (S

VIB

), non-integration (S

NI

), and forward integration

(S

VIF

). The equilibrium organizational form is then given by

z

∗

= arg max

z∈{VIB,NI,VIF}

S

z

.

Equilibrium investments are determined as the Nash equilibrium of a game

where each party chooses its investment so as to maximize utility, given the other

party’s investment and the ownership structure. More formally, the equilibrium

conditional on the ownership structure z is given by the pair {e

∗

S

(z), e

∗

P

(z)} such

that

e

∗

P

(z) = max

e

P

y

z

P

(e

P

,e

∗

S

(z)

−

P

(e

P

)},

e

∗

S

(z) = max

e

S

y

z

S

e

∗

P

(z), e

S

−

S

(e

S

)

,

where the expressions for y

z

i

(.) are given in equation (4), and those for

P

and

S

are given in equation (2). The Nash equilibrium investment levels under each

of the three ownership structures can be calculated as

e

∗

P

(VIB) = p, e

∗

S

(VIB) =

λ

2

s, (7)

e

∗

P

(NI) =

1 −

ϕ

2

p, e

∗

S

(NI) =

1 + θ

2

s, (8)

e

∗

P

(VIF) =

λ

2

p, e

∗

S

(VIF) = s. (9)

These expressions highlight the effect of the different ownership structures

on investment incentives. The investment made by the producer is highest under

16. With credit constraints, the less constrained party may become the owner even when this

structure does not maximize the ex ante social surplus, because the other party does not have the

cash to compensate the first party for giving up ownership (see, for example, Aghion and Tirole

(1994a), or Legros and Newman (2008)).

17. Suppose that the equilibrium involves z

∗

,butS

z

∗

<S

z

. Then the producer, who has the

bargaining power in the first stage of the game, can propose z

together with a compensating transfer

to the supplier, and increase its payoff. Namely, she can offer

T

S

(z

) = T

S

(z

∗

) + y

z

∗

S

− y

z

S

−

S

e

∗

S

(z

∗

)

+

S

e

∗

S

(z

)

+ ε

with ε>0, which would be at least as attractive for the supplier, and for ε<S

z

−S

z

∗

, also profitable

for the producer, thus yielding a contradiction.

1000 Journal of the European Economic Association

backward vertical integration (i.e., e

∗

P

(VIB)>e

∗

P

(NI)>e

∗

P

(VIF)), whereas that

made by the supplier is highest under forward vertical integration (i.e., e

∗

S

(VIF)>

e

∗

S

(NI)>e

∗

S

(VIB)).

Most relevant for our empirical analysis are our results that backward vertical

integration increases the investment of the producer and reduces the investment

of the supplier relative to non-integration. This is a fundamental result in this

class of models: Backward vertical integration reduces the supplier’s outside

option and increases the share of the surplus accruing to the producer. It therefore

discourages supplier investment and encourages producer investment. Another

important feature is that with non-integration, the investment level of the pro-

ducer is decreasing in ϕ, because a greater share of costs increases the scope for

holdup by the supplier. Also with non-integration, the investment of the supplier

is increasing in θ because a greater θ provides her with a better outside market

(the outside market is irrelevant for the other organizational forms, since one of

the parties has residual rights of control over the input and the assets).

Finally, substituting for e

∗

S

(z) and e

∗

P

(z) in equation (6), we obtain the total

surplus under the three ownership structures, S

VIB

, S

NI

, and S

VIF

, and the com-

parison of the surpluses gives the following proposition (the relevant expressions

and the proof are provided in Appendix A).

Proposition 1. There exist r

, ¯r, and ˆr such that the unique subgame perfect

equilibrium ownership structure, z

∗

, is given as follows.

• If r

< ¯r, then z

∗

= VIB for p/s > ¯r, z

∗

= NI for p/s ∈ (r, ¯r), and z

∗

= VIF

for p/s < r

. Moreover,

∂ ¯r

∂ϕ

< 0,

∂r

∂ϕ

> 0,

∂ ¯r

∂θ

> 0,

∂r

∂θ

< 0.

• If r

≥¯r, then z

∗

= VIB for p/s > ˆr, and z

∗

= VIF for p/s < ˆr. Moreover,

∂ ˆr

∂ϕ

> 0 and

∂ ˆr

∂θ

= 0.

Proposition 1 summarizes the most important comparative static results that

will be empirically investigated in the second part of the paper. Because the

empirical analysis will focus on the margin between backward integration and

non-integration, we assume henceforth that r<¯r and restrict the discussion of

the comparative statics to this margin.

First, the proposition implies that, given the other parameters, the choice of

organizational form depends on p and s. When p is high, or s is low, backward

integration is the equilibrium organizational form. Non-integration emerges when

p is low or s is high. Intuitively, backward integration becomes more likely when

p is large because, in this case, the tasks in which the producer specializes are

Acemoglu et al. Vertical Integration 1001

highly “technology intensive” (i.e., the producer’s activity brings more value

added), so increasing the producer’s investment is the first priority. Backward

vertical integration achieves this by increasing the producer’s outside option and

reducing that of the supplier. In contrast, when s is large, backward integration

becomes less likely, because the investment of the supplier is now more important,

and by reducing the supplier’s outside option backward integration discourages

her investment.

Second, an increase in ϕ makes backward integration more likely relative

to non-integration. A greater share of costs (of the supplier’s inputs in the pro-

ducer’s total costs) increases the degree to which the producer will be held up by

the supplier. Backward vertical integration becomes more preferable because it

avoids this problem. In addition, this result also implies that there are important

interaction effects: The positive effect of p/s on backward vertical integration is

amplified by ϕ. To see this let us focus of the comparison between non-integration

and backward integration, and denote the surplus difference between these two

organizational forms by

B

≡ S

VIB

− S

NI

. Then we have that

∂

2

B

∂ϕ∂p

> 0 and

∂

2

B

∂ϕ∂s

< 0.

This prediction is also quite intuitive. It suggests that when the relation-

ship between the producer and the supplier is less important, their respective

technology intensities should have less effect on integration decisions.

Finally, a greater θ makes non-integration more likely relative to backward

vertical integration; with a greater θ, the supplier invests more under non-

integration because she has a better outside option, and this makes non-integration

a more desirable organizational form. If we interpret θ as the degree of competi-

tion in the market, this result would imply that, consistent with some of the claims

made in the popular press, greater competition encourages non-integration over

both backward and forward integration. However, a more appropriate interpre-

tation might be that θ is a function of the ratio of producers to suppliers in the

market because, with a larger number of producers, the supplier is more likely

to find a suitable match in the secondary market after a breakup. In this case,

an increase in competition, associated with an increase in the numbers of both

suppliers and producers, need not increase non-integration.

2.3. Summary and Empirical Hypotheses

We can summarize the most important empirical hypotheses from our framework

as follows.

1. Technology intensities of the producer and the supplier should have opposite

effects on the likelihood of vertical integration.

1002 Journal of the European Economic Association

2. These effects should be amplified when the supplier accounts for a larger

fraction of the input costs of the producer.

3. Focusing on backward vertical integration, greater technology intensity of

the producer, lower technology intensity of the supplier, and greater share

of costs of the producer accounted by inputs from the supplier should make

vertical integration more likely.

4. Finally, again focusing on backward vertical integration, we may also expect

the number of producing firms relative to supplying firms to encourage non-

integration.

In light of these empirical hypotheses, we next investigate the potential

determinants of vertical integration.

3. Data and Measurement

3.1. Vertical Integration

Central to our empirical strategy is a measure of vertical integration. As discussed

in the Introduction, to compute such a measure we need to organize the data in

a specific way. Motivated by the previous literature, we look at the data from the

viewpoint of the producing firm and ask whether for each potential supplying

industry that producer is vertically integrated or not. This conceptual exercise

amounts to constructing a measure proxying for backward vertical integration

(even though because we do not observe which firm/manager has residual rights

of control, this is not identical to backward vertical integration in the theory).

More precisely, for each firm i = 1, 2,...,N, our first measure is a dummy

vi

ij k

for whether, for each product (industry) j = 1, 2,...,J it is producing, the

firm owns a plant in industry k = 1, 2,...,K supplying product j :

vi

ijk

=

1 if firm i owns a plant in industry k supplying industry j ,

0 otherwise.

(10)

This measure provides a direct answer to the question of whether each producing

firm can supply some of its own input k necessary for the production of product

j. However, it does not use any information on how much the firm produces in

its own plants.

We also construct an alternative (continuous) measure using this information.

Let c

ij

denote the total cost (including intermediate, capital, and labor costs) of

firm i in producing j, and w

jk

denote the proportion of total costs of producing j

that are made up of input k, which is obtained from the UK Input–Output Table.

We can think of c

ij

w

jk

as the firm’s demand for input k for product j (to obtain

the firm’s total demand for k we sum over j). Let y

ik

denote the amount of k that

Acemoglu et al. Vertical Integration 1003

firm i produces. The alternative measure of the degree of vertical integration of

firm i in the industry pair jk is calculated as

18

vi

ijk

= min

y

ik

c

ij

w

jk

, 1

. (11)

When a firm produces several different products that demand input k, and where

the total demand is greater than what can be supplied by the firm itself, we assume

that it allocates the input across plants proportionately to their demand, so that

the measure becomes

vi

ijk

= min

⎧

⎪

⎨

⎪

⎩

y

ik

j

c

ij

w

jk

, 1

⎫

⎪

⎬

⎪

⎭

. (12)

In practice, there is little difference between vi

ijk

and vi

ijk

, because when a firm

owns a plant in a supplying industry, it is typically sufficient to cover all of its

input requirements from that industry. So for most of our analysis, we focus on

the vi

ijk

measure.

Our main source of data is the Annual Respondents Database (ARD).

19

This

is collected by the UK Office of National Statistics (ONS) and firms have a legal

obligation to reply. These data provide us with information on input costs and

output for each production plant located in the UK at the four-digit industry level

and on the ownership structure of these plants.

20

These data do not, however, tell

us directly whether a plant purchases inputs from a related plant in the same firm.

Data on the demand for intermediate inputs are available at the two-/three-digit

industry level from the Input–Output Domestic Use Table. The Input–Output

Table contains information on domestic input flows between 77 manufacturing

industries, giving 5,929 pairs of producing–supplying industries, 3,840 of which

have positive flows. Appendix Table B.1 lists all 77 (supplying) industries together

with their largest purchaser and other information.

Because of the level of aggregation of the Input–Output Table, one difficulty

arises when we look at industry pairs where the input and output are in the same

18. Davies and Morris (1995) construct a related index with more aggregate data, whereas Fan and

Lang (2000) measure corporate relatedness using a similar measure.

19. This data set is constructed using the data from the Annual Business Inquiry from 1998 and

onward. Before that the name of the Inquiry was The Annual Census of Production (ACOP). See

Griffith (1999) and Barnes and Martin (2002) for a description of these data.

20. Data on employment are available for all plants. Data on other inputs and output are available

at the establishment level. An establishment is often a single plant, but can also be a group of plants

owned by the same firm that operate in the same four-digit industry. We have input and output data

on all establishments with over 100 employees, data from smaller establishments are collected from

a random stratified sample and values for non-sampled plants are imputed. Throughout, we exclude

single plant firms with fewer than 20 employees.

1004 Journal of the European Economic Association

two-/three-digit industry. In this case, we consider a firm to be vertically integrated

only if it has plants in more than one of the four-digit industries within that

two-/three-digit industry. Further details on the construction of these measures

are provided in Appendix B.

We should emphasize again that all of the measures here are conceptually

similar to backward vertical integration. In particular, we are measuring the prob-

ability that a producer is vertically integrated with each potential supplier (rather

than the probability that a supplier is vertically integrated with each potential

producer).

3.2. Technology Intensity and the Share of Costs

Our main measure of technology intensity is R&D intensity, but we also report

robustness results using investment intensity. Both these measures are at the indus-

try level rather than at the firm level for two reasons: First, our methodology

focuses on the technology of an industry, not on whether a specific firm is more

R&D or investment intensive; second, we need measures that apply both to inte-

grated and non-integrated relationships, which naturally takes us to the industry

level.

R&D intensity is measured as R&D expenditure divided by total value

added.

21

We use R&D data pre-dating the vertical integration sample (1994–

1995). The total value added in the denominator includes all firms in the industry

(both those performing R&D and those that do not).

R&D intensity is our preferred measure because it is directly related to invest-

ment in new technologies. A possible concern is that the distribution of R&D

across industries is rather skewed. Another concern might be that R&D could be

spuriously correlated with vertical integration; for example, because it is better

reported in industries with many large firms and large firms are more likely to

be vertically integrated (though, in many specifications, we also control for firm

size).

For these reasons, we consider an alternative indicator of industry technology

by looking at physical investment intensity. This information is reported at the

level of the firm’s line of business and can be directly linked to the producing

or supplying part of vertically integrated firms. It is also more widely reported

and less skewed both within and between industries. As with R&D data, we use

data pre-dating the measure of vertical integration, 1992–1995, and aggregate the

data from the firm’s line of business to the industry level. The disadvantage of this

21. We have data on R&D and value-added at the firm–industry level. We use these data to construct

R&D and value-added by summing over all firm–industry observations in each industry. In the UK

these data on R&D are reported separated both by the industry of the firm conducting the R&D

and the product category for which the R&D is intended. This enables us to have a more accurate

measurement of R&D by producing and supplying industries.

Acemoglu et al. Vertical Integration 1005

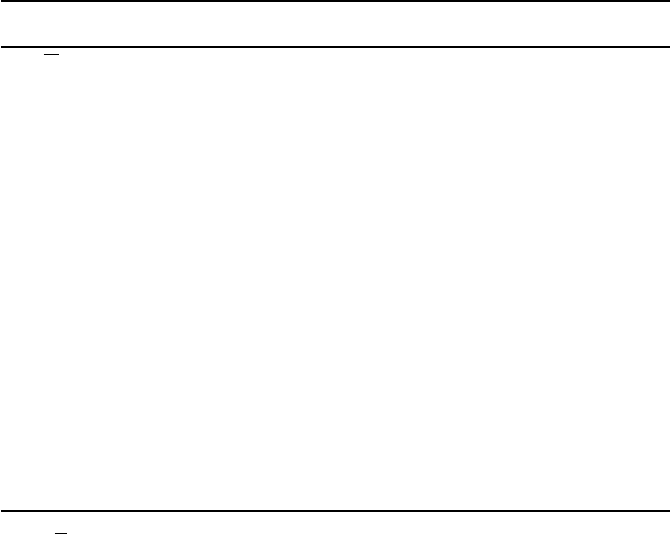

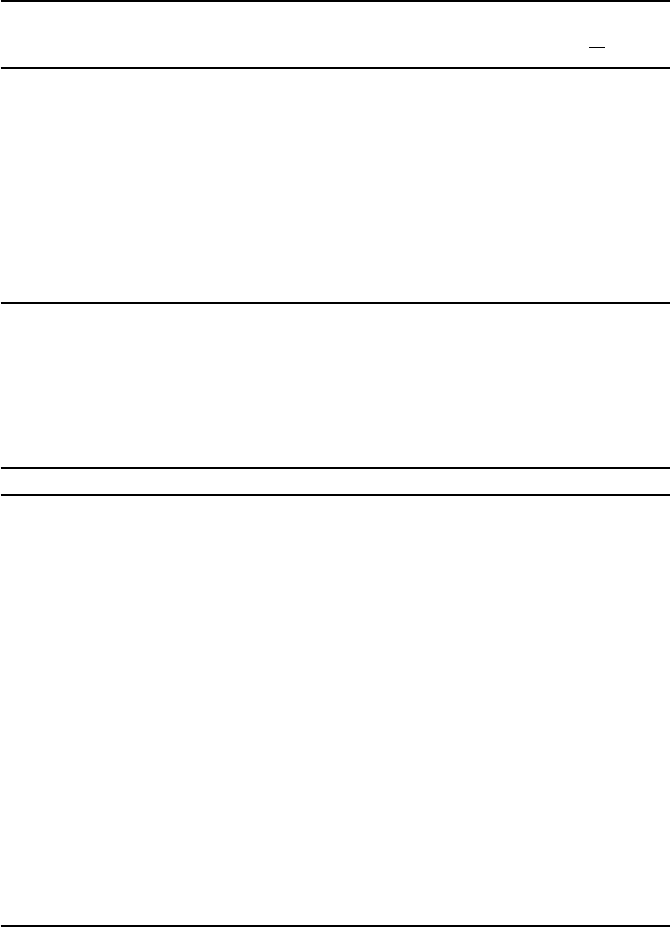

Table 1. Descriptive statistics.

Producer R&D Supplier R&D

Variable Mean (s.d.) low high low high

Mean vi

ijk

0.008 0.007 0.010 0.008 0.009

(0.087)(0.078)(0.096)(0.084)(0.089)

Mean of vi

ijk

0.009 0.009 0.013 0.010 0.011

(0.091)(0.093)(0.114)(0.101)(0.104)

Firm age 10 10 10 10 10

(7) (7) (7) (7) (7)

Firm employment 111 99 125 109 112

(455) (346) (559) (444) (465)

Share of producer costs (j k) 0.010 0.010 0.010 0.012 0.009

(0.034)(0.038)(0.029)(0.040)(0.028)

Producing industry

R&D over value-added 0.027 0.004 0.055 0.026 0.028

(0.055)(0.002)(0.072)(0.055)(0.055

)

Investment over value-added 0.101 0.095 0.109 0.102 0.101

(0.041)(0.031)(0.049)(0.040)(0.041)

Mean number of firms in industry 5757 8267 2763 5755 5759

(6585) (7978) (1635) (6525) (6636)

Supplying industry

R&D over value-added 0.046 0.044 0.050 0.005 0.082

(0.107)(0.103)(0.113)(0.003)(0.137)

Investment over value added 0.122 0.123 0.122 0.106 0.136

(0.057)(0.057)(0.057)(0.038)(0.067)

Mean number of firms in industry 2316 2320 2309 3347 1433

(3730) (3727) (3733) (5065) (1471)

Source: Authors’ calculations using the UK ONS data. All statistical results remain Crown Copyright.

Notes:

vi

ijk

is a continuous measure of the share of the producers demand that can be met by its own supply. vi

ijk

is a

dummy for whether a firm owns plants in both producing and supplying industries. Share of producer costs (j k) is the

share of producers in industry j total costs (including labour and capital) that is on input k (from the Input–Output Table).

The sample contains 2,973,008 observations on 46,392 firms. Numbers reported are means (standard deviations). The

first column reports on the whole sample. Subsequent columns split the sample by median producer R&D and supplier

R&D intensities.

measure relative to R&D intensity is that physical investment intensity may be less

related to technology and may also have a more limited firm-specific component,

which is important for the model we have used to motivate our empirical analysis.

The share of costs between each industry pair jk, sc

jk

, is calculated from

the Input–Output Table as the share of inputs from industry k in the total cost of

industry j (£ of input k necessary to produce £1 of product j ).

3.3. Descriptive Statistics

Table 1 gives descriptive statistics for the whole sample, and also for subsamples

separated according to whether the producer (supplier) has a high or low R&D

intensity. There are 3,840 industry pairs where the Input–Output table indicates

that transactions occur. There are 46,392 manufacturing firms with twenty or

more employees operating in the UK at some time over the period 1996–2001.

1006 Journal of the European Economic Association

Because individual firms seldom change their organization structure over this

short time period we collapse the data into a single cross-section. An observation

in our data represents a firm i producing product j which uses input k; this gives

us 2,973,008 observations at the firm–industry pair level.

The first row of Table 1 gives the mean and standard deviation of the con-

tinuous measure of vertical integration,

vi

ijk

. The mean is 0.008 with a standard

deviation of 0.087, which shows that there is substantial variation across firms

and at the sub-firm level. There is also substantial variation within industry pairs.

To illustrate this, we calculate the average within-industry-pair standard deviation

of

vi

ijk

, which is 0.086 (not shown in the table). This indicates that, even within a

relatively narrow industry-pair, there is as much variation in the extent of vertical

integration as in the whole sample.

The low mean of this variable is driven by the large number of zeros. The

mean of

vi

ijk

conditional on vi

ijk

> 0 (not shown) is 0.93. This indicates that

if a firm can produce some of its inputs k in-house, it can typically produce all

that input (k) necessary for production.

22

This motivates our focus on the simpler

dummy variable vi

ijk

, which indicates whether the firm owns a plant producing

input k which it needs in the production of the product j (see equation (10)). Not

surprisingly, the second row shows that the mean of this variable, 0.009, is very

similar to that of

vi

ijk

.

The other columns illustrate the differences in the extent of vertical integration

when we separate firm–industry pairs by producer R&D intensity and supplier

R&D intensity. These differences, which will be investigated in greater detail

in the subsequent regression analysis, indicate that vertical integration is higher

when the R&D intensity of the producing industry is high. Interestingly, the

descriptive statistics do not show any difference between vertical integration when

we cut the sample by whether the R&D intensity of the supplying industry is high

or low.

23

The regression analysis will show a negative effect of supplier R&D

intensity as well as supplier investment intensity on vertical integration, but due

to nonlinearities in this relationship (see also Appendix Table B.3), the high–low

cut does not show this result.

R&D intensity is positively correlated with investment intensity, although the

correlation is quite low (0.251). The relatively weak correlation between these

measures means that each measure is an imperfect proxy for the overall technology

intensity of the sector, and consequently, there might be some attenuation bias

22. Naturally this does not imply that if a firm is vertically integrated for one of its inputs, it is also

vertically integrated for its other inputs. In fact, the mean of

k

w

jk

vi

ijk

conditional on vi

ij k

> 0

for some k

is 0.053, so on average, across firms that are vertically integrated in any one input, firms

are vertically integrated in around 5% of their total inputs demanded.

23. When we group firms on the basis of investment intensity, we see that greater supplier investment

intensity is associated with lower vertical integration. This cut of the data is not shown in Table 1 to

save space.

Acemoglu et al. Vertical Integration 1007

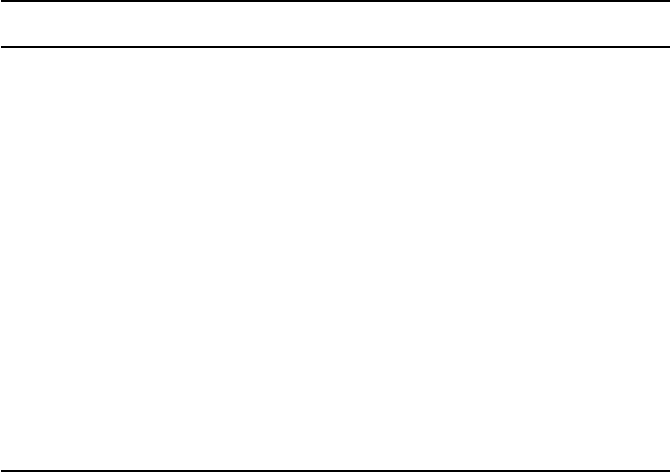

Table 2. Main results—R&D intensity.

(1) (2) (3) (4) (5) (6)

Dependent variable: vi

ijk

Share of costs (j k) 0.204 0.187 0.187 0.182

(0.029)(0.028)(0.028)(0.027)

R&D intensity, 0.038 0.040 0.044 0.037 0.030

producing (j ) (0.006)(0.005)(0.005)(0.005)(0.005)

× Share of costs 1.112 1.104 1.067

(0.402)(0.397)(0.374)

R&D intensity, −0.010 −0.007 −0.013 −0.013 −0

.007

supplying (k) (0.002)(0.001)(0.003)(0.003)(0.003)

× Share of costs −0.909 −0.914 −0.871

(0.353)(0.351)(0.324)

ln Firm size (ij) 0.0053 0.0052

(0.0002)(0.0002)

ln Firm age (ij) 0.0010 0.0009

(0.0001)(0.0001)

ln Average firm size, 0.0011

producing (j ) (0.0005)

ln Average firm size, −0.0036

supplying (k) (0.

0004)

ln Average firm age, 0.012

producing (j ) (0.003)

ln Average firm age, 0.004

supplying (k) (0.002)

Source: Authors’ calculations using the UK ONS data. All statistical results remain Crown Copyright.

Notes: The dependent variable is a dummy for whether a firm is vertically integrated in that industry pair at any time

over the years 1996–2001. There are 2,973,008 observations at the firm–industry pair level. Standard errors in parentheses

are clustered at the level of 3,840 industry pairs. The right-hand side variables firm size and firm age are measured at the

firm–industry pair level in 1996 (age is equal to 1 if the firm enters that industry pair after 1996). R&D intensity is R&D

carried out in the UK divided by value–added produced in the UK, taken from plant level R&D data, aggregated to the

two-/three-digit industry level and average over the years 1994–1995. Share of costs is from the 1995 Input–Output Table

and is at the industry pair level. Average firm size and age are calculated from the firm–industry pair data and average

over the years 1996–2001. In regression with interactions, all main effects are evaluated at sample means.

in our estimates of the relationship between technology intensity and vertical

integration. It also suggests that these measures capture different dimensions of

technology intensity, so that it is useful to study the relationship between each of

them and vertical integration separately.

Table 1 also shows the means and standard deviations of the other main

covariates, defined in Appendix B.

4. Results

4.1. Benchmark Specification

Table 2 reports the main results. It reports estimates from the following linear

probability model:

vi

ijk

= αsc

jk

+ β

P

RD

P

j

+ β

S

RD

S

k

+ X

ijk

η + ε

ijk

, (13)

1008 Journal of the European Economic Association

where sc

jk

is the share of costs, RD

P

j

is R&D intensity in the producing industry

j, RD

S

k

is R&D intensity in the supplying industry k, X

ijk

is a vector including

the constant term and firm and industry characteristics (firm size and age, average

firm size and age in producing and supplying industries). The main coefficients

of interest are α, β

P

, and β

S

. The regressions are at the firm–industry-pair level,

while some of the main regressors are at the (producing or supplying) industry

level. For this reason, throughout all standard errors are corrected for clustering

at the industry-pair level.

24

The first two columns of Table 2 consider the bivariate relationship between

R&D intensity in the producing and supplying industries and vertical integra-

tion. Column (1) shows a positive and highly statistically significant relationship

between R&D intensity in the producing industry and vertical integration. The

estimate of β

P

is 0.038 with a standard error of 0.006. Column (2) shows a nega-

tive and highly statistically significant relationship between R&D intensity in the

supplying industry and vertical integration; the estimate of β

S

is −0.010 (standard

error of 0.002). These relationships are robust to the inclusion of other covariates

in the rest of the table.

The third column includes both R&D intensity variables and the share of

costs. The R&D intensity variables continue to be highly statistically significant,

with coefficients close to those in columns (1) and (2) (0.040 and −0.007), and the

share of costs is positive and also statistically significant. The pattern of opposite

signs on R&D intensity of producing and supplying industries is consistent with

our first empirical hypothesis discussed in Section 2.3.

Moreover, the directions of the effects of R&D intensities and the share of

costs are in line with our third empirical hypothesis, that is, they are consistent

with the theory provided that the relevant choice in the data is between backward

vertical integration and non-integration. This is reassuring, because we not only

believe that this is the case (based on the bulk of evidence in the prior literature)

but also because, as explained earlier, we organized the data to have a measure

conceptually corresponding to backward vertical integration.

Our second empirical hypothesis from Section 2.3 suggests the possibility of

interaction effects between the share of costs and R&D intensity. To investigate

this issue, we modify our estimating equation to

24. There is also a potential correlation between observations for the same firm in different industry

pairs. Unfortunately, we were unable to estimate a variance–covariance matrix with multiple random

effects or multiple levels of clustering, due the large size of the data set. Nevertheless, we believe that

the downward bias in the standard errors should be small in our case, because, as noted in footnote

22, the probability of a firm that is vertically integrated for one of her inputs also being integrated for

other inputs is relatively small. In any case, in Table 3, we estimate these models including a full set

of firm fixed effects (for those firms that operate in more than one industry), which directly removes

any potential correlation across firm observations.

Acemoglu et al. Vertical Integration 1009

Table 3. Within-firm variation.

(1) (2) (3) (4) (5)

Dependent variable: vi

ijk

vi

ijk

vi

ijk

= 1 if multi product vi

ijk

Share of costs (j k) 0.434 0.434 0.414 0.025 0.475

(0.054)(0.053)(0.050)(0.094)(0.058)

R&D intensity, producing (j) 0.073 0.024 0.014 0.333 0.030

(0.012)(0.016)(0.017)(0.025)(0.012)

× Share of costs 2.725 2.786 2.607 −0.058 2.741

(0.917)(0.880)(0.816)(1.048)(0.

915)

R&D intensity, supplying (k) −0.041 −0.042 −0.021 0.019 −0.016

(0.009)(0.009)(0.008)(0.024)(0.005)

× Share of costs −2.434 −2.543 −2.303 0.914 −2.482

(0.897)(0.865)(0.786)(0.990)(0.891)

ln Firm size (ij) 0.0024 0.0044

(0.0004)(0.0008)

ln Firm age

(ij) 00004 0.0076

(0.0005)(0.0007)

ln Average firm size, 0.003 0.014

producing (j ) (0.002)(0.005)

ln Average firm size, −0.012 −0.0005

supplying (k) (0.001)(0.0042)

ln Average firm age, −0.006 0.352

producing (j ) (0.010)(0.021)

ln Average firm age, 0.017 −0.0019

supplying (k) (0.005)(0.0224)

Observations 891,942 891,942 891,942 2,973,008 891,942

Fixed effects no 6,713 firms 6,713 firms no no

Source: Authors’ calculations using the United Kingdom Office of National Statistics data. All statistical results remain

Crown Copyright.

Notes: In columns (1)–(3) and (5) the dependent variable is a dummy for whether a firm is vertically integrated in that

industry pair at any time over the years 1996–2001. In column (4) the dependent variable is whether or not the observations

are for a multiplant firm. Standard errors in parentheses are clustered at the level of 3,840 industry pairs. R&D intensity

is R&D carried out in the UK divided by value added produced in the UK, taken from plant level data, aggregated to the

two-/three-digit industry level and average over the years 1994–1995. Share of costs is from the 1995 Input–Output Table

and is at the industry pair level. In regression with interactions, all main effects are evaluated at sample means.

vi

ijk

= αsc

jk

+ (β

P

+ γ

P

sc

jk

)RD

P

j

+ (β

S

+ γ

S

sc

jk

)RD

S

k

+ X

ijk

η + ε

ijk

, (14)

with γ

P

and γ

S

as the additional coefficients of interest. Theory suggests that γ

P

should have the same sign as β

P

, and that γ

S

should have the same sign as β

S

,so

that the effects of R&D intensity in producing and supplying industries should

be amplified when there is a greater share of costs. Throughout, when including

interaction terms, we report the main effects evaluated at the sample mean, so that

these estimates are comparable to those in the models without interaction effects.

The estimates in column (4) are consistent with the theoretical predictions.

The main effects are close to those in the previous columns, and the interaction

effects are large and statistically significant: γ

P

is positive (1.112 with a standard

error of 0.402), while γ

S

is negative (−0.909 with a standard error of 0.353).

1010 Journal of the European Economic Association

Columns (5) and (6) add a number of characteristics at the firm-line of busi-

ness and industry level, namely firm size and age (in that line of business), and

average firm size and average firm age in producing and supplying industries. All

five coefficients of interest are robust, and remain close to their baseline values

(the only minor exception is β

P

, which declines from 0.040 in column (3) to

0.030 in column (6)). The coefficients on the controls are also interesting. They

indicate, for example, that larger and older firms are more likely to be vertically

integrated, which is plausible. Furthermore, greater average firm size in the pro-

ducing industry makes vertical integration more likely, while average firm size

in the supplying industry appears to reduce the probability of integration. This

opposite pattern of coefficients, with firm size in the producing industry having a

positive effect, is also consistent with our conjecture that the relevant margin in

the data is backward integration.

Overall, the results in Table 2 show an interesting pattern of opposite-signed

effects from technology intensity in producing and supplying industries (which is

consistent with our first empirical hypothesis in Section 2.3). They also show that

these effects are magnified when the share of costs accounted for by the supplying

industry in the total costs of the producing industry is large (which is consistent

with our second empirical hypothesis). In addition, the direction of the effects is

also consistent with our measurement strategy and the theory provided that the

relevant margin in the data is backward vertical integration (our third empirical

hypothesis).

Before further investigating the robustness of our findings, it is useful to

discuss the economic magnitudes of the estimates in Table 2. The implied mag-

nitude of the main effects is very small. For example, the coefficient of −0.013

in column (4) of Table 2 suggests that a one standard deviation (0.107) increase

in the R&D intensity of supplying industry reduces the probability of vertical

integration by slightly more than 0.1% (−0.013 × 0.107 ≈−0.001). However,

this small effect applies at the mean of the distribution of share of costs, which

is 0.010. If, instead, we evaluate the effect at the 90th percentile of the share of

cost distribution, which is about 0.20, then the overall effect is much larger; again

using the numbers from column (4), a one standard deviation increase in sup-

plier R&D intensity leads to almost a 2% decrease in the probability of vertical

integration (−0.001 +[−0.909 × 0.19 × 0.107]≈0.02). Similarly, the impact

of producer R&D intensity is small when evaluated at the mean, about 0.2%,

(0.037 × 0.055 ≈ 0.002), but sizable, 1.4%, when evaluated at higher levels of

share of costs (0.002 +[1.104 × 0.19 × 0.055]≈0.014).

This pattern is in fact quite sensible. For the vast majority of industry pairs,

the scale of the relationship between the producer and the supplier is so small

that it would be surprising if technology intensity were of any great importance

for integration decisions. Our theory should instead be relevant for industry pairs

where the scale of the relationship (as measured by the share of costs) is large,

Acemoglu et al. Vertical Integration 1011

and this is exactly where we see a significant positive effect of the R&D intensity

of producing industries and a significant negative effect of the R&D intensity of

supplying industries. This discussion also implies that the interaction effects are

as important as the main effects for the relevance of the pattern documented here.

4.2. Within-Firm Variation

A more demanding test of the relationship between technology intensity and

vertical integration is to investigate whether a particular firm is more likely to

be vertically integrated in producing industries that are more technologically

intensive and with supplying industries that are less technology intensive. This is

done by estimating a model including firm fixed effects.

Naturally, this can only be investigated using multiplant firms, namely, those

that produce in more than one industry, which introduces a potential selection

bias. At some level, this is mechanical; vertically integrated firms have to be

multiplant firms. More generally, producer and supplier technology intensity may

affect the likelihood of being a multiplant firm differentially, and if so, regressions

on the subsample of multiplant firms may lead to biased estimates of the effect

of technology (R&D) intensity on vertical integration.

In Table 3, we investigate both the robustness of our results to the inclusion

of firm fixed effects and potential selection issues.

Column (1) reports our basic specification (without fixed effects) on multi-

plant firms only. Comparing this to column (4) of Table 2, a number of features

are noteworthy. First, the number of observations is now 891,942 rather than

2,973,008 as in Table 2. Second, despite changes in coefficient estimates, the

overall pattern is quite similar. In particular, there is a positive effect of producer

R&D intensity and a negative effect of supplier R&D intensity on vertical inte-

gration. Both these effects are larger than those in Table 2. The interaction effects

also have the expected signs. This pattern of results is reassuring, because it shows

that our main results in Table 2 were not driven by the contrast of single to multi-

plant firms. Within multiplant firms, those with greater producer R&D intensity

are also more likely to be vertically integrated, while those with greater supplier

R&D intensity are less likely to be vertically integrated.

Column (2) adds a full set of firm fixed effects to the specification in column

(1). This has surprisingly little effect on the results. The coefficients on the share of

cost, the interaction between producer R&D intensity and share of cost, supplier

R&D intensity and the interaction between share of costs and supplier R&D

intensity, are essentially identical to those in column (1). The only change is in

the main effect of producer R&D intensity, which falls from 0.073 to 0.024 and

is no longer statistically significant.

However, it is important to emphasize that even though producer R&D inten-

sity is insignificant when evaluated at the mean, the overall pattern is not very

1012 Journal of the European Economic Association

different; due to the significant interaction effect, producing industries with sub-

stantial R&D intensity are much more likely to vertically integrate activities

that are important for their products. In fact, because the interaction effect is

larger than in Table 2, the effect of a one standard deviation increase in pro-

ducer R&D intensity on the probability of vertical integration for a pair at the

90th percentile of the share of costs distribution is now greater than in Table

2at3%(0.03 × 0.055 +[2.741 × 0.19 × 0.055]≈0.030), rather than 1.4%

when using the estimates from column (5) of Table 2. Similarly, now a one-

standard deviation increase in supplier R&D intensity has a larger effect, 5%

(−0.016 × 0.107 +[−2.482 × 0.19 × 0.107]≈0.052), rather than 2% when

using the estimate from column (5) of Table 2.

Column (3) repeats the model of column (2) including the full set of covari-

ates. The results are similar to those in column (2), except that the coefficients on

the level of producer and supplier R&D decline.

These specifications do not deal with the potential selection problem. In

columns (4) and (5) we estimate a standard Heckman selection model. Column

(4) shows estimates from the probit model of the probability of a firm being a

multiproduct firm as a function of the full set of variables used to explain vertical

integration. Among the main variables of interest, only the R&D intensity of the

producing industry turns out to have an effect on the probability of a firm of

being multiproduct, whereas the share of costs, R&D intensity of the supplying

industry, and the interaction of producer and supplier R&D intensities with the

share of costs appear to have no influence on multiplant status. This implies that