KPMG Malta

kpmg.com.mt

Employment

related

obligations and

policies

Employment and industrial relations

Overview

Other relevant legislation

Other provisions delineated in this document fall under the following main legislation and their respective subsidiary legislation:

• Employment and Training Services Act (1990)

• Equal Opportunities Act (2000)

• Equality for Men and Women Act (2003)

• Occupational Health and Safety Authority Act (2002)

• Social Security Act (1989).

In 2002, the Maltese Parliament enacted legislation on employment and industrial relations, thus consolidating previous

applicable labour law into one piece of legislation. The Employment and Industrial Relations Act (2002) which is in line with

the EU acquis communitaire, sets up the Employment Relations Board principally responsible to promote the introduction of

national minimum standard conditions of employment and sectoral conditions of employment aimed at ensuring standard

conditions of employment in all sectors. The Act is accompanied by subsidiary legislation, that is Wage Regulations and

Orders and the regulation of certain conditions of employment for specific sectors.

Contents

Overview 1

Definition of employee 2

Contract of employment 3

Termination of contracts of employment 4

Other obligations 5

Wages 6

Working periods 8

Official memberships 9

Industrial Tribunal 10

Social security system 10

Statutory holidays 12

Leave entitlement 13

Third country nationals 15

Training 16

Apprenticeships 16

Aid programmes / schemes 17

Health and safety 18

KPMG - a full service 20

1

Employment related obligations and policies

ii

Employment related obligations and policies

A person may bind himself

*

to give his services for a fixed term or for an indefinite period

Contract of employment

Probation period

• The first six months of any employment under a contract of service is considered

probationary employment unless otherwise agreed by the employer and employee for a

shorter period

• Employees holding technical, executive, administrative or managerial posts and whose

wages are at least double the minimum wage established in that year, such probation

period is of one year unless otherwise specified in the contract of service or in the

collective agreement

• During the probationary period the contract of employment may be terminated without

assigning any reason, provided one weeks’ notice is given when an employee has been in

employment of the same employer continuously for more than 1 month. However, it should

be noted that there is an exception in the case where an employee is pregnant or has

recently given birth or who is breastfeeding.

A Contract of service/employment is defined in the Act as an agreement (other than service as a member of a disciplinary

force) whether oral or in writing, in any form, whereby a person binds himself to render service to or to do work for an

employer, in return for wages, and, in so far as conditions of employment are concerned, includes an agreement of

apprenticeship.

Where a written contract of employment has been signed between the employer and employee, the employer is bound to

deliver to the employee a signed copy of the agreement by no later than 8 working days from the date of the contract.

If no written contract of employment has been signed or less information that is required by law has been provided to the

employee, the employer must give or send to the employee a letter of engagement or a signed statement, by no later than

8 working days from the commencement of employment which must include certain information as stipulated by the law.

According to Maltese law, any employee on a fixed term contract of service whose contract has expired and is retained

by his employer shall be deemed to be retained on an indefinite period contract if the said employee is not given a new

contract of service for a fixed term within the first twelve working days following the expiry of the previous contract.

In a situation where:

• the employee has been continuously employed under the contract of service (taken together with previous contracts

for a fixed term) exceeding a period of four years and

• the employer cannot provide objective reasons to justify the limitation of a renewal of such a contract for a fixed term,

the contract of service for a fixed term shall be transformed into a contract of service for an indefinite duration.

It is the employer’s duty to inform employees on a contract of service for a fixed term about

vacancies which become available in the place of work and to give such employees the same

opportunity as other employees to secure work on a contract of service for an indefinite time

within the place of work.

The Employment and Industrial Relations Act identifies different categories of employees

Whole-time employee

Part-time employee / Employee

with reduced hours

• An employee who is deemed to be a whole-time employee in terms of any recognised

conditions of employment

• If a person has more than one whole-time employment, the employment for which social

security contributions are payable is considered to be the whole-time employment of the

employee.

• This category of employee works for less than the number of hours of work applicable in

terms of the recognised conditions of employment to a whole-time employee and for which

social security contributions are also being paid.

• The employee falling in this category is paid pro rata than the wage applicable to a whole-

time employee in similar employment and is entitled to a share pro rata of the following,

which whole time employee in similar employment with the same employer are entitled in

terms of recognised conditions of employment applicable to them:

— the entitlement of public holidays with pay and annual vacation leave

— benefits such as maternity leave, parental leave and leave for urgent family reasons

— any entitlement of injury leave and

— any entitlement to statutory bonus.

*

For the purposes of this document, the masculine gender includes the feminine and the singular includes the plural, unless the

context otherwise requires.

3

Employment related obligations and policies

2

Employment related obligations and policies

Rules on commencement and termination of employment

The following rules apply to the commencement and termination of an employment relationship:

• Mandatory documentation is required from employers regarding their self-employment or the recruitment of employees

within the company/business

• Employers are required to notify Jobsplus of the employment of new personnel/staff (by means of an engagement form)

not later than the same day of the commencement of employment

• Likewise self-employed persons taking up a gainful occupation whole-time, part-time or otherwise, shall notify Jobsplus of

such employment not later than the same day of the commencement of self-employment

• Jobsplus shall thereafter issue an acknowledgement as early as possible

• On termination of employment, the employer is to, within four days from the date of termination, notify the Corporation by

means of a specific termination form, duly signed, of the date of termination

• The Corporation shall thereafter issue an acknowledgement as early as possible

• Subject to exceptions provided in the regulations, no employer shall employ a minor of compulsory school age

• Prohibited employment: any employer who employs any person who is not a Maltese citizen, other than such person in

possession of a work permit, shall be guilty of an offence, liable on conviction to a fine as stipulated at law. The Court shall,

at the request of the prosecution and in addition to such punishment, order the suspension/cancellation of any licence held

by the offender and relating to trade/business or relating to any business premises where such person is employed

• Every employer shall submit to Jobsplus a list of employees who were in their employment at any given time.

Other obligations

Discrimination

• Labour legislation recognises victimisation and harassment as offences punishable with a fine and/or imprisonment for a

period of up to six months

• No person can be victimised for making a complaint to the lawful authorities or for initiating or participating in proceedings

for redress on grounds of alleged breach of the provisions of the law or for having disclosed confidential or non-confidential

information, to a designated public regulatory body, regarding alleged illegal or corrupt practices being committed by

the employer or agents thereof. Likewise an employer cannot harass an employee and nor can an employee harass

his employer or another employee. The employer may not discriminate between persons either during the process of

employing or within the term of employment itself

• In terms of the Act, discriminatory treatment includes “Any distinction, exclusion or restriction which is not justifiable in a

democratic society, including discrimination made on the basis of marital status, pregnancy or potential pregnancy, sex,

colour, disability, religious conviction, political opinion or membership in a trade union or in an employers association. “ Any

person who feels that s/he has suffered any such discriminatory treatment may bring forward a claim before the Industrial

Tribunal or the First Hall of the Civil Court, as the case may be.

In the case of contracts of employment for a fixed term period, if an employee is dismissed before the expiration of the time

specified in the contract of employment, the employer must pay the employee one-half of the full wages that would have

accrued to the employee in respect of the remainder of the time specifically agreed upon.

On the other hand, an employee who wishes to terminate his (fixed term) contract of employment before the date of expiry of

the contract, he must pay the employer a sum equal to one-half of the full wages to which the employee would have become

entitled to if he had continued in the service of the employer for the remainder of the time originally agreed upon.

Indefinite period contracts

Termination of contacts of employment

Before terminating a contract of employment for an indefinite period, the employee or the employer has to give due notice to

the other party. In practice, once notice by the employee has been given the employer may elect to do any one of the following:

• keep the employee in his employment during the term of the notice or

• elect to terminate the employee immediately by paying the employee a sum equal to the full wages that the employee

would have earned during the notice period.

Notice of termination may not be given if an employee is pregnant or has recently given birth or who is breastfeeding.

If an employee (under the contract of employment for an indefinite period) fails to give notice, he is liable to pay the employer

a sum equal to half the wages that would be payable in respect of the period of notice. If the employer fails to give the said

notice, he is liable to pay the employee a sum equal to the wages that would be payable in respect of the period of notice.

Definite period contracts

In both circumstances, an employer may dismiss the employee, and an employee may abandon

the service of the employer, without giving notice and without liability to make payment if there

is good and sufficient cause for such dismissal or abandonment of service.

There are specific provisions at law with respect to collective redundancies whereby an employer terminates the employment

of a specific number of employees on the grounds of redundancy, over a period of thirty days.

• An employee on an indefinite term contract (whether full time or part

time) may terminate his contract of employment by giving notice to the

employer of his intention to resign.

• The notice periods vary depending on the length of employment the

employee has been with the same employer continuously:

— for more than one month but not more than six months - one week

— for more than six months but not more than two years - two weeks

— for more than two years but not more than four years - four weeks

— for more than four years but not more than seven years - eight weeks

— for more than seven years, an additional 1 week for every subsequent

year of service up to a maximum of twelve weeks

— or such longer periods as may be agreed by the employer and employee

in the case of technical, administrative, executive or managerial posts

(within which categories the employees would fall).

5

Employment related obligations and policies

4

Employment related obligations and policies

Statutory Bonuses

Every employee is entitled to statutory bonuses. These

bonuses are payable as follows:

All part-time employees, are entitled pro rata to any

entitlement to statutory bonuses and other income

supplements to which comparable whole-time employees on

similar duties with the same employer are entitled in terms of

the recognised conditions of employment applicable to them.

Source: Wage Increase National Standard Order

One of the fundamental rights of every worker is the right to receive payment.

An employee is entitled to receive full wages earned by or payable to him in money being of legal tender in Malta. Wages shall

be paid directly to the employees to whom they are due except where expressly permitted by the Act or as may otherwise

be provided by any law (for example, national security contributions and income tax) or in virtue of an order made by a

competent court (for example, maintenance orders) or where the employee/s concerned agree to the contrary, or permitted

in an agreement entered into between an employer/s or an organisation of employers and a trade union or trade union

representatives of the employees concerned. Wages must be affected on working days only, must be paid to employees at

regular intervals which should not exceed 4 weeks in arrears, and the employer may not impose any conditions on how the

wages are to be paid, spent or otherwise.

Wages are considered privileged debts. Any claim by an employee in respect of a maximum of three months of his current

wage together with all outstanding leave and termination benefits, up to a maximum of the equivalent of six months of

the current national minimum wage, shall constitute a privileged claim over the assets of the employer and shall be paid in

preference to all other claims. Furthermore the Guarantee Fund’s purpose is to guarantee payment of unpaid wages due by an

employer to those employees whose employment is terminated due to the employer’s proved insolvency.

The national minimum wage per week (related to a normal working week) in Malta during 2016 is as follows:

• Age 18 years and over: €168.01

• Age 17 years: €161.23

• Under 17 years €158.39

The conditions and minimum wages applicable to employees engaged in specific industry sectors are prescribed by means

of Wage Regulation Orders (e.g. Professional Offices Wages Council Wage Regulation Order). Most wage regulation orders

confirm the national minimum wage as the minimum wage for the sector concerned, establishing higher wages for categories

other than unskilled workers.

Wages

Cost of living increases

General increases in wages are determined by Government by notice in the gazzette and employers are required to increase

the wages of every employee in their employment accordingly. The table provides the historical cost of living increases for

whole-time employees.

Effective Date Increase in wage per week €

1st January 2016 1.75 per week

1st January 2015 0.58 per week

1st January 2014 3.49 per week

1st January 2013 4.06 per week

1st January 2012 4.66 per week

• €121.16 – which is paid out in March and September

• €135.10 – government bonus, which paid out in June and

December.

7

Employment related obligations and policies

6

Employment related obligations and policies

Working periods

Working time and rest periods

The average working time for each seven-day period of a worker, including overtime must not exceed 48 hours.

Employees are entitled to a minimum daily rest period of 11 consecutive hours per 24-hour period during which the worker

performs work for his employer. Employees are also entitled to a rest break where the working day is longer than six hours. The

rest break (unless specified in the provisions of any collective agreement in place) must be for an uninterrupted period of not

less than fifteen minutes.

Furthermore, an employee is entitled to a minimum uninterrupted weekly rest period (normally of 24 hours) for every seven day

period. The weekly rest can be excluded due to technical or work organisation conditions once the approval of the Director of

Employment and Industrial Relations has been sought and obtained.

Night work and shift work

Night time means period between 10 p.m. of any one day and 6 a.m. of the next day. A night worker means a worker who:

A night worker’s normal hours of work must not exceed an average of eight hours in any twenty-four hour period, so long as the

average number of hours worked each night is calculated on the total number of hours worked in a reference period as defined

by collective agreements, or in any other case by any period of seventeen weeks in the course of employment and provided

that if the minimum weekly rest period of twenty-four hours required falls within the reference period it should not be included

in the calculation of the average.

The employer has to ensure that no night worker whose work involves special hazards or heavy physical or mental strain shall

work more than eight hours in any period of twenty-four hours during which night work is performed.

Moreover, work involving special hazards or heavy physical or mental strain must be recognised as such by means of:

Prior to assigning the employee to carry out night work, and at regular intervals thereafter, it is the duty of the employer to take

the necessary measure to ensure the employee concerned undergoes a health assessment, to be repeated when there is a

change in working environment and when a ‘reasonable time’ has lapsed.

In situations where employees are required to work during a period which would otherwise be a rest period/break, the

employee shall be allowed such compensatory rest equivalent to the requirements of daily rest and weekly rest. In exceptional

cases where this is not possible, for objective and exceptional reasons, the employer must afford the employee such

protection as may be appropriate to safeguard the worker’s health and safety.

Employers’ organisations

Employers’ associations aim at bringing together private businesses and employers from all sectors and industry. Among

these are the General Retailers and Traders Union and the Malta Employers’ Association. Other organisations which cater for

business interests are the Chamber of Commerce, Enterprise and Industry and the Federation of Industry.

Membership with sector specific organisations is also widespread. For example, the Malta Bankers’ Association, which is

a coordinating and lobbying body, for banks operating in Malta, on sectoral issues and policies; and the Malta Hotels and

Restaurants Association.

Malta Council for Economic and Social Development (MCESD)

The Maltese government, and the main trade unions and employer organisations meet regularly in the MCESD to discuss

issues of economic and social relevance. The council has an advisory role and makes recommendations to the Maltese

government prior to any reforms or measures being implemented.

Trade unions

All employees have the option to be represented at work by a workers union.

As of February 2016, there were 32 registered trade unions, of which the most prominent being the General Workers Union

(GWU) and United Workers Union (UHM) which both have sector specific sections or departments.

Sector specific trade unions include the following: Malta Union of Bank Employees; Airline Pilots Association Malta; the

Medical Association of Malta; Association of Airline Engineers; University of Malta Academic Staff Association; Malta Union of

Teachers.

Collective agreements negotiated by unions tend to have more favourable conditions of employment than those accorded by

the laws in force.

• works at least three hours of his daily working time as a normal course during night time or

• works more than fifty per cent of his annual working time, or such lower proportion as may be specified in appropriate

provisions of a relevant collective agreement during night time.

• a risk assessment carried out by the employer or

• appropriate provisions in collective agreements specifying particular work activities, taking account of the specific

effects and hazards of night work.

9

Employment related obligations and policies

8

Employment related obligations and policies

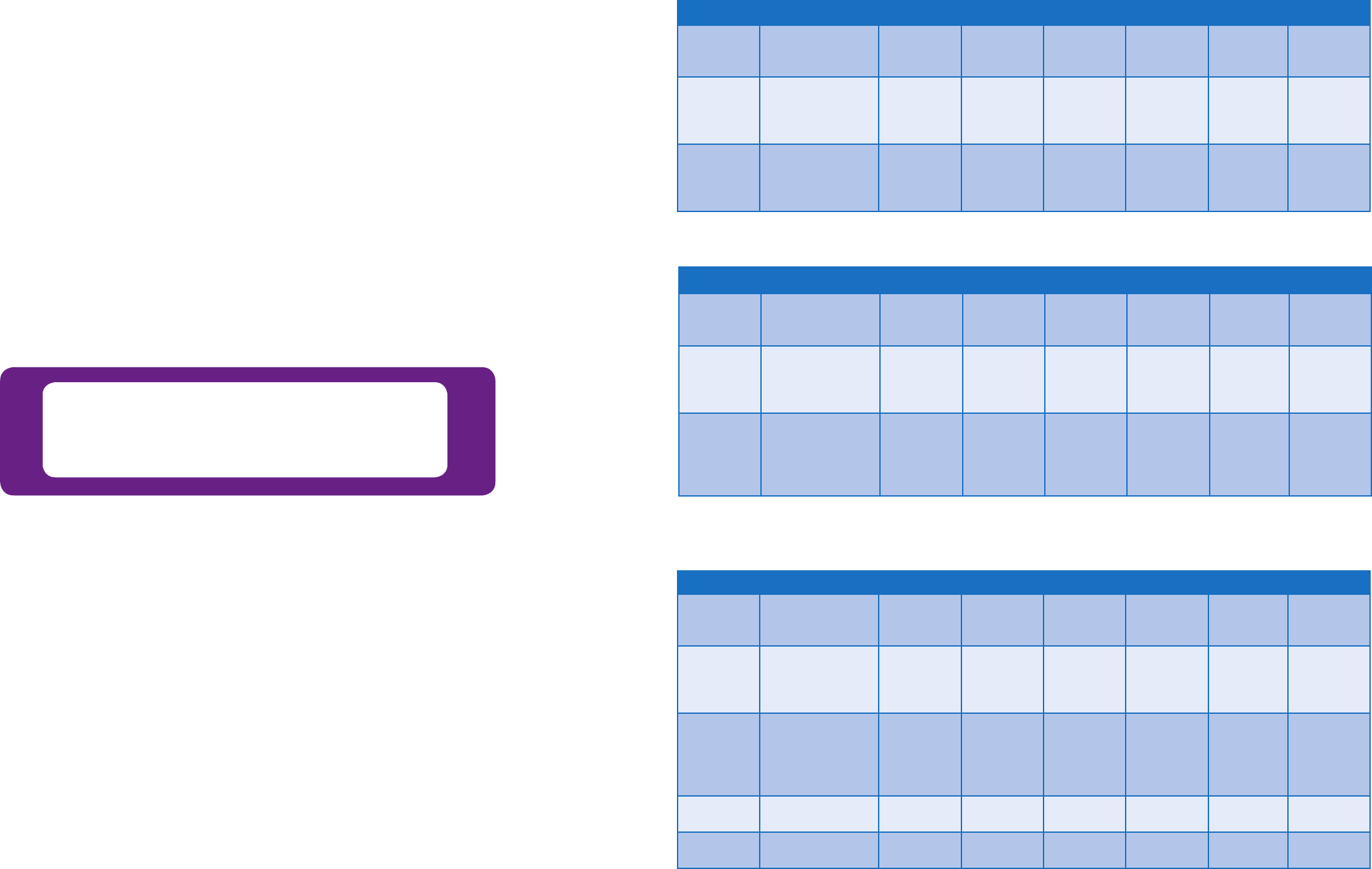

Category Description Basic Weekly Wage € Weekly Rates Payable €

From To

By

Employee

By

Employer

Total

Maternity

fund

contribution

A

Persons under 18

years of age earning

not more than the

amount indicated

0.10 168.01 6.62 6.62 13.24 0.20

B

Persons aged 18

and over, earning

not more than the

amount indicated

0.10 168.01 16.80 16.80 33.60 0.50

Social Security Rates 2016

Category Description Basic Weekly Wage € Weekly Rates Payable €

From To

By

Employee

By

Employer

Total

Maternity

fund

contribution

C

All persons whose

basic weekly wage

is between the

amounts indicated

168.02 344.86 10% 10% N/A 0.3%

D

All persons whose

basic weekly

wage is equal to

or exceeds the

amount indicated

344.87 N/A 34.49 34.49 68.68 1.03

Persons born up to 31st December 1961

Category Description Basic Weekly Wage € Weekly Rates Payable €

From To

By

Employee

By

Employer

Total

Maternity

fund

contribution

C

All persons whose

basic weekly wage

is between the

amounts indicated

168.02 425.73 10% 10% N/A 0.3%

D

All persons whose

basic weekly

wage is equal to

or exceeds the

amount indicated

425.74 N/A 42.57 42.57 85.14 1.28

E

Students under 18

years of age

N/A N/A

10% (Max.

4.38)

10% (Max.

4.38)

N/A

0.3% (Max.

0.13)

F

Students 18 years

old and over

N/A N/A

10% (Max.

7.94)

10% (Max.

7.94)

N/A

0.3% (Max.

0.24)

Persons born from 1st January 1962 onwards

Industrial Tribunal

Settlement of disputes

The Department of Industrial and Employment Relations (DIER) plays a major role in the voluntary settlement of industrial

disputes through its services of conciliation and mediation. In order to try and achieve a voluntary settlement to a trade dispute,

the law provides for the setting up a Conciliation Panel. Where disputes are not resolved through conciliation, the matter

may be resolved by a duly appointed court of inquiry or on application by both parties to the dispute refer such dispute to the

Industrial Tribunal.

The Industrial Tribunal has exclusive jurisdiction to consider and decide in all cases dealing with alleged unfair dismissals and

all matters regulated by the provisions of the Act dealing with employment relations. In the case of unfair dismissals and in

determining the amount of compensation to be given, the Industrial Tribunal shall take into consideration the real damages and

losses incurred by the worker who was unjustly dismissed, as well as other circumstances, including the worker’s age and

skills as may affect the employment potential of the said worker.

Any award by the Industrial Tribunal is binding on employers and employees to whom it relates. An appeal before the Court of

Appeal may be lodged but only on a point of law within twelve days from the date of the decision of the Industrial Tribunal.

The Industrial Tribunal is currently in the process of

being revamped so as to better fulfil its function.

Social security system

Social security is provided by a system of social insurance and a system of social assistance regulated by the Social Security

Act (Chapter 318 Laws of Malta). Social insurance provides benefits to insured persons by virtue of the contributions

payable at law in this regard. The social assistance scheme provides financial assistance subject to a means test or to special

circumstances in respect of unemployment, sickness, work injury, maternity, marriage, medical care, disablement and

invalidity; pension on retirement, and widowhood, amongst others.

For persons employed in insurable employment, three contributions per week must be payable in accordance with the Social

Security Act. One payment must be made by the employee, another by the employer and the third out of the consolidated fund

(i.e. a public fund).

Employers are liable to pay both the contribution payable by himself/herself and also on behalf of and to the exclusion of the

employee. The contribution paid by the employer on behalf of the employee is considered to be contributions paid by the

employed person.

The table below sets out the applicable weekly rates of contribution payable by an employee and employer.

11

Employment related obligations and policies

10

Employment related obligations and policies

Leave entitlement

Sick leave

Sick leave entitlements vary from one industry to another and the period of entitlement may depend on the duration of

employment, as outlined in the various Wages Council Wage Regulation Orders. For example, the Professional Offices Wages

Council Wage Regulation, states that in every calendar year a whole-time employee is entitled to the equivalent in hours of

twenty days sick leave on full pay. Where an employee’s entitlements are not covered by a Wage Council Regulation Order, in

every calendar year the employee is allowed sick leave of at least the equivalent in hours of two working weeks sick leave on

full pay.

Annual leave

Every worker is entitled to be paid annual leave of at least the equivalent in hours of four weeks and four working days

calculated on the basis of a 40 hour working week and an eight hour working day. Out of such paid annual leave entitlement, a

minimum period equivalent to four weeks may not be replaced by an allowance in lieu, except on termination of employment.

Any agreement to the contrary shall be null and void.

In cases where the average weekly working time, calculated on the basis of a reference period of 17 weeks, is below or

exceeds 40 hours per week, the annual leave entitlement in hours must be adjusted accordingly, provided that the average

weekly working time is calculated on the normal hours of work of the employee and must not include overtime hours.

Maternity leave

An employee may apply for maternity leave for an uninterrupted period of fourteen weeks and is entitled to maternity with full

wages. The employee is required to give notification to the employer in writing of the date when she intends to avail herself at

least 4 weeks before the maternity leave begins.

An employee on a fixed term contract enjoys the same rights for the duration of the contract.

Parental leave

Both male and female employees are entitled to unpaid parental leave on the grounds of birth, adoption or legal custody to

enable them to take care of that child for a period of 3 months until the child has attained the age of 8 years. This right shall be

granted on a non-transferable basis and parental leave shall be availed of in established periods of one month each.

An employee desiring to take parental leave is to give due notice in terms of law to his employer. Upon receiving such notice,

the employer may elect to postpone the granting of parental leave for “justifiable reasons related to the operation of the

workplace”.

Statutory Holidays

1st January New Year's Day

10th February Feast of St. Paul’s Shipwreck

19th March Feast of St. Joseph

31st March Freedom Day

Date varies Good Friday

1st May Workers’ Day

7th June Sette Giungo

29th June Feast of St. Peter & St. Paul

15th August Feast of the Assumption

8th September Feast of our Lady of Victories

21st September Independence Day

8th December Feast of the Immaculate Conception

13th December Republic Day

25th December Christmas Day

Customary public and national holidays

Whole-time employees are entitled in every calendar year to the national holidays and to all

public holidays with full pay.

With effect from 1st January 2005, public holidays falling on a Saturday or on a Sunday, are not

considered as public holidays for the purposes of entitling an employee to an additional day of

vacation leave.

13

Employment related obligations and policies

12

Employment related obligations and policies

Third country nationals

During a stay in Malta with a valid visa or prior to such visit, the prospective employer must apply for the employment licence

in respect of the 3rd country national. This may take up to 3 months to be processed and issued (during this time the individual

may apply to have his visa extended upon evidencing the application for the licence). Once issued, the residence permit may

be applied for.

These may also take up to 3 months to be issued, both must be renewed on an annual basis. In some cases the employer

would have to provide or the individual would have to ensure that adequate health insurance coverage is in place, covering both

the 3rd Country National and any dependants who may be accompanying him / her.

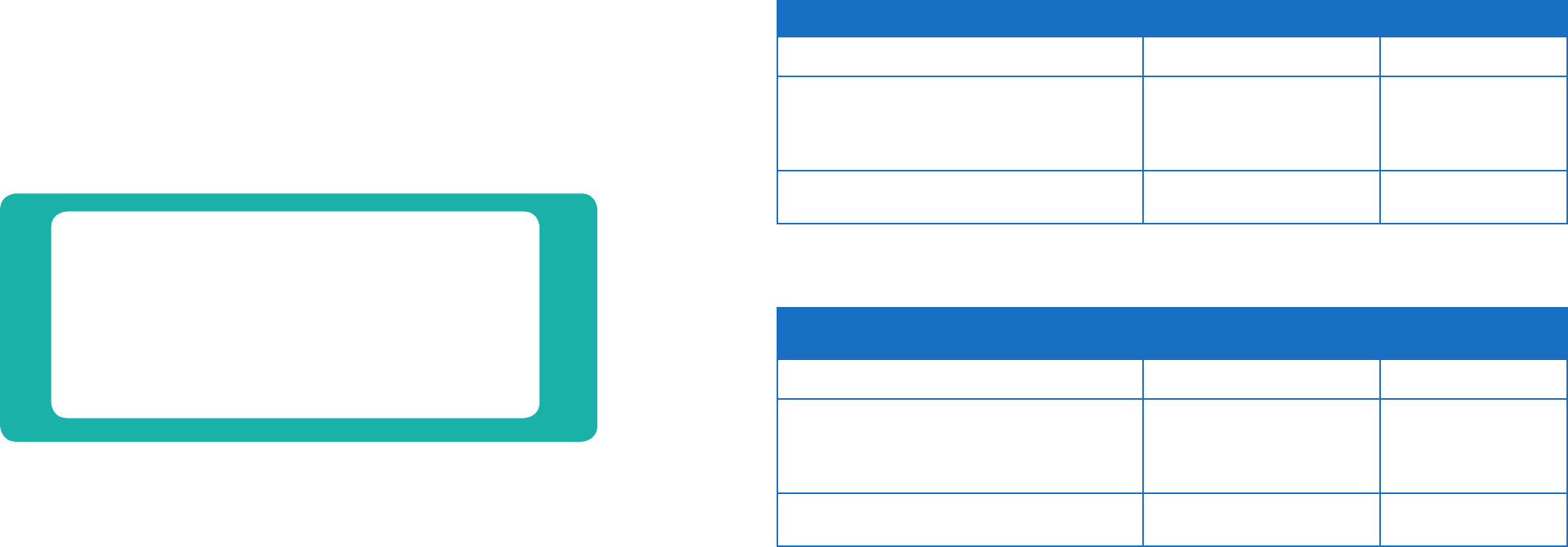

Application fees for employment licence Payable on application Payable on issue

Third country national: Long-term residents €58

Asylum seekers; recognised refugees; beneficiaries of

subsidiary protection and persons granted analogous

forms of protection

€58

All other third country nationals €150 €80

Source: Immigration (Residence Permits and Employment Licences) (Fees) (Amendment) Regulations, 2009, L.N. 254 of

2009.

Annual renewal of an employment

licence

Payable on application Payable on issue

Third country national: Long-term residents €34

Asylum seekers; recognised refugees; beneficiaries of

subsidiary protection and persons granted analogous

forms of protection

€34

All other third country nationals €150 €80

Source: Immigration (Residence Permits and Employment Licences) (Fees) (Amendment) Regulations, 2009, L.N. 254 of

2009.

Urgent family leave

All employees are entitled to time off from work on grounds of force majeure for urgent family reasons in cases of sickness

or accident making the immediate presence of the employee indispensable. In such cases, the employer is bound to grant to

every employee a minimum total of fifteen hours with pay per year as time off from work, to deal with emergencies arising

in relation to persons related to them up to the first degree. The total number of hours availed of by the employee for urgent

family reasons must be deducted from annual leave entitlement of employee.

Other

Employees are further entitled to be granted:

Provided that these specific leave entitlements may vary depending on the applicable Wages Council Wage Regulation Order.

Rights and benefits

The employee on maternal or parental leave is

entitled to all the rights and benefits which may accrue

to other employees of the same class or category of

employment at the same place of work.

• one working day of bereavement leave

• one working day leave on the occasion of the birth of any child to the wife of the employee

• two working days marriage leave

• up to one year of injury leave and

• time off for jury service, for as long as necessary.

15

Employment related obligations and policies

14

Employment related obligations and policies

Aid programmes / schemes

Access to Employment Scheme

Access to Employment (A2E) Scheme provides employment aid to enterprises in Malta and Gozo to promote the recruitment

of the more challenged amongst jobseekers and inactive persons.

Employers who engage eligible individuals shall receive a subsidy of €85 per week per new recruit for 26 weeks, 52 weeks

or 104 weeks, depending on the target group. In the case of registered disabled persons, a subsidy of €125 per week for a

maximum of 156 weeks is provided.

The A2E Scheme is co-financed by the European Social Fund, the Maltese Government and employers.

Average Wage Earner Scheme

This scheme assists employed and self-employed persons attending one of Jobsplus courses and whose weekly wage does

not exceed €300 (basic) per week.

Jobsplus offers training courses in various areas including literacy and numeracy, computing, trade, technical, accounting,

clerical work and care services. Employed individuals following these courses can benefit from a financial grant of €25 per

week provided that they attend a minimum of four hours of training per week.

Bridging the Gap Scheme

Registered disabled persons & other people in disadvantaged situations can engage in a period of work exposure with an

employer to enable them to demonstrate the skills needed for a particular job.

For the duration of the scheme, registered participants will be exempted from the weekly registration. Clients receive a weekly

allowance of 80% of the minimum wage from Jobsplus while renouncing the rights to any social security benefits throughout

the work exposure phase if the period exceeds twenty-eight weeks.

Employers participating in this scheme are exempted from social security contributions, wages and sick leave benefits.

Throughout this work exposure phase, the employer can benefit from the support of Jobsplus officials.

Mature Workers Scheme

Employers, including self-employed individuals, who as from 2014 employ persons aged between 45 and 65, and who have

been registering for work on Parts 1 and 2 of the unemployment register for the preceding six months, will have their income

tax deducted pro-rata, as per the following information.

Employers will receive up to a maximum of €11,600 in tax deductions on the chargeable income for the first two years of

employment for each eligible employee. This will result in savings of €5,800 per annum.

Moreover, employers who engage eligible employees may benefit from a further tax deduction of 50% of the cost of training

up to a maximum of €400 per employee.

Work Exposure Scheme

The Work Exposure Scheme is intended to facilitate transition into employment by providing jobseekers with initial hands

on training that will help individuals obtain the knowledge, skills and competences required to find and retain employment.

This scheme is designed to mirror contemporary labour market demand, whereby the job preferences of the jobseekers are

matched with employers’ requests.

The duration of the work exposure will be 12 weeks and a participant is to report to the place of work for an average of 20

hours/week. The on-the-job training will take place at the employer’s premises with whom the trainee is placed. Participants

are paid a training allowance upon participation in the Work Exposure Scheme; this grant is calculated on the national minimum

wage. Unemployed registrants participating in the scheme will be exempted from the weekly registration.

The Work Exposure Scheme forms part of the Training for Employment project, which may be considered for co-financing by

the European Social Fund 2014-2020.

Training

The Malta College of Arts, Science and Technology (MCAST) is a public college providing postsecondary vocational education

which offers quality full-time and part-time professional and vocational education and training programmes that respond to

the current as well as the growing and changing demands of industry. The college provides young people and adults with

the knowledge, skills and competences as a solid basis for a career and lifelong learning in support of Government’s ongoing

investment in better jobs and in ensuring social inclusion.

MCAST works together with the major stakeholders, social partners and professional bodies in order to satisfy the demands

for a skilled labour force and to review the changing needs of each industrial sector. Over the past years, the private sector has

been emerging in new areas where demand has been greater than the capacity of public institutions, or in particular niches

were no provision was available. In order to address this issue, Malta adopted a strategic approach to ensure an adequate

supply of appropriate and flexible skills.

Apprenticeships

In Malta, apprenticeship schemes are based on a dual system, where the apprentice follows a training programme at

vocational educational institution as well as carries out on-the-job training at a place of work. Apprenticeship schemes are

administered by the Training Services Division within Jobsplus and are organised in collaboration with vocational educational

providers.

The responsibilities of Jobsplus include the following:

The two schemes available are:

The apprentice, the employer (also known as the sponsor) and Jobsplus enter into an agreement laying down the rights and

obligations of all parties during the apprenticeship. According to Legal Notice 82 of 1990 (Technician Apprenticeship Scheme)

and Legal Notice 73 of 1998, all apprentices are entitled to a maintenance grant (paid by government) and a wage. The stipends

vary according to the year within the apprenticeship that the apprentices spends on-the-job training.

• Marketing of Schemes with Prospective Participants and Parents

• Issue call for applications

• Promotion of the apprenticeship scheme with prospective apprentices and employers

• Assisting persons who wish to embark on an apprenticeship to find a suitable training

placement

• Provide assistance to organizations wishing to sponsor apprentices

• Monitor the on-the-job training of apprentices

• Co-ordinate the trade testing process of apprentices on completion of their

apprenticeship.

1. Technical Apprenticeship Scheme, which leads the apprentice to obtain an occupational competence at technician

level (in areas such as aircraft maintenance, computer engineering, industrial electronics, mechanical engineering,

telecommunications, amongst others)

2. Extended Skills Training Scheme, whereby the apprentice learns a trade or skill at craftsman level (for example as

electrical installer, plumber, plasterer, welder, etc).

17

Employment related obligations and policies

16

Employment related obligations and policies

Health and safety

The Occupational Health and Safety Authority Act came into force on the 29th of January 2002, and provided for the

establishment of an authority known as the Occupational Health and Safety Authority. The Authority is responsible for ensuring

that the physical, psychological and social well-being of all workers in all work places are promoted and to ensure that they are

safeguarded.

The Occupational Health and Safety Authority Act places the following duties with employers:

Duties placed on the employees by the Act include safeguarding one’s own health and safety and that of others, and co-

operating with the employer and health and safety representative/s on matter relating to health and safety.

Subsidiary legislation on occupational health and safety outline in detail, for specific health and safety related areas, the duties

and responsibilities of both employers and employees.

Over time Malta has developed and implemented an extensive body of legislation on

occupational health and safety.

• to ensure health and safety at all times of all workers who may be affected by work being carried out for such an

employer

• to take measures to prevent physical and psychological occupational ill-health, injury or death, following a number of

general principles of prevention

• to provide such information, instruction, training and supervision as is required to ensure occupational health and

safety

• to ensure that at work places wherein a sufficient number of workers are employed, there shall be an elected, chosen

or otherwise designated a person or persons to act as the workers’ health and safety representative(s), and who

shall be consulted in advance and in good time by the employer on matters which may affect occupational health and

safety.

19

Employment related obligations and policies

18

Employment related obligations and policies

KPMG Malta - part of a global network

• KPMG is a unique global network of strong national practices (i.e.

member firms) that provide Audit, Tax and Advisory services to local,

national and multinational organisations

• As a leading global professional services Firm, KPMG operates

across 144 countries, with over 130,000 employees worldwide. From

Afghanistan to Zambia, KPMG people come from many different

backgrounds, but everyone shares a common set of values and follows

the same code of conduct

• Locally, KPMG’s position in the marketplace very much reflects the

status of a ‘Big Four’ accountancy and professional services firm. With

the strength of its member firms and the global breadth and balance

of its operations, KPMG has the resources to deliver quality services

worldwide through its network and delivers a globally consistent set of

multidisciplinary financial and accounting capabilities based on deep

industry knowledge

• Throughout the world, the guiding philosophy of KPMG is to provide its

clients with the highest quality service, to assist them in developing a

rich understanding of their businesses. We provide the insight, skills and

resources required to assist our clients in addressing industry-specific

issues and opportunities, as well as to challenge clients to look at their

organisations and their markets in new ways.

KPMG in Malta is a leading provider of professional services including audit, tax and advisory with a local staff complement of

over 250 professionals. The firm was founded in 1969 and is situated at ‘Portico Building’ Marina Street, Pietà, Malta.

KPMG is a full service Firm and offers clients a wide range of inter-related services to both audit and non-audit clients:

• Audit: Provision of statutory and regulatory attestation services; provision of advice in relation to compliance with statutory

reporting requirements

• Tax: Tax compliance; advice on direct and indirect taxes, incentives legislation, employee taxes, and cross-border tax

planning; international business support services

• Advisory: This includes:

In carrying out our work, we apply the highest standards demanded by the profession. We provide our services objectively and

have in place rigorous procedures to ensure independence and adherence to the profession’s and the firm’s ethical rules.

KPMG delivers its services through lines of business. For our clients this means exceptional people with an intimate industry-

specific knowledge. We know that the success of investing in a jurisdiction depends on the right structure, maximum tax

efficiency, effective risk awareness as well as outstanding performance and distribution capability. Our practice brings together

knowledge and resources to provide clients with a comprehensive range of practical support across many different areas. Our

commitment to excellence in all these areas makes KPMG a natural partner for success.

How KPMG in Malta can help you

• Our philosophy is to help clients maximise business advantage

from the challenge of relocating all or part of their operations to

Malta, based on innovative strategies and a sound approach to

regulatory and business risk management

• The position of KPMG today is the product of the way in which we

handle the issues that matter most to our clients, the dedication

of our people to engendering competitive advantage for the

businesses they serve, and our ability to provide a seamless

service

• The result is a clear focus on the issues that really matter to you.

— the provision of advice on governance, risk management and internal controls

— business strategy and process improvement advisory services

— financial advisory services including corporate finance, transaction services and restructuring

— accounting advisory services

— information systems advisory services.

21

Employment related obligations and policies

20

Employment related obligations and policies

Follow KPMG in Malta: Download the KPMG in Malta App:

Mark Bamber

Partner

Advisory Services

T: +2563 1135

Contact us

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be

no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough

examination of the particular situation.

© 2016 KPMG, a Maltese Civil Partnership and a member rm of the KPMG network of independent member rms aliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

The KPMG name and logo are registered trademarks or trademarks of KPMG International Cooperative (KPMG International).

Printed in Malta.

June 2016

Background

Mark commenced his career in the public service with responsibilities for economic

policy and planning. He later held management positions in the private sector,

ultimately joining KPMG as a Consultant in 1997.

Since joining KPMG, Mark has developed the Business Advisory service line, focusing

on the provision of strategic and business planning, economic analysis, strategic and

turnaround planning, and business process improvement services, to a client base

comprising both public and private sector clients.

Professional and Industry Experience

Mark has also led numerous engagements for clients in the public and private sectors

relating to the formulation of strategic and business plans and the drawing up of

turnaround plans. Mark has assisted clients in restructuring their operations, and in the

analysis of business performance metrics to enable strategic decision making.

Mark is an economist with more than ten years of economic analysis and macro

forecasting experience in the public sector. He has led numerous engagements on

economic issues, market/industry analysis, and project/concept economic analysis.

He has led multi-disciplinary teams in projects such as economic strategic planning,

the identification of competitive advantage, the formulation of industrial incentives or

“economic triggers”, the setting up of regulatory structures and their financing/tariff

structures, and in cost-reduction or cost rationalisation initiatives.

In the course of these engagements, Mark has provided leadership and project

managed engagements of diverse size and complexity.

Mark Bamber

Partner

Advisory Services,

Management Consulting

KPMG

Portico Building

Marina Street

Pieta’

Malta

Tel +356 2563 1000

Function and Specialisation

Partner, Advisory Services,

Management Consulting

Education, Licences & Certifications

• B.A. (Hons) Business Management, University of Malta

• Masters in Business Administration, Henley/Brunel, UK

• MSc in Financial Economics, University of London

• Mark is a part-time doctoral researcher in Economics at Strathclyde University,

where he is focusing on global foreign direct investment flows with particular

reference to small economies.

• Member of the Malta Institute of Management

• Member of the Institute for the Management of Information Systems

• Member of the Institute of Financial Services Practitioners

22

Employment related obligations and policies