Global Employment

Compass

PHILIPPINES

Contents

1. Summary of applicable rights for different

categories of workers ........................................ 2

2. Legal requirements/rights/ practices for

different categories of workers ........................... 3

a. Employees ................................................... 3

b. Independent contractors/consultants* ............. 19

c. Volunteers.................................................... 24

d. Non-citizen employees and consultants, including

refugees and others forcibly displaced ................. 27

This document provides brief answers and recommendations to readers for information purposes.

The information contained in this document is general and may differ according to the

circumstances. Thus, this document does not constitute legal advice. We decline in advance any

responsibility should you decide to act upon any information contained in this document.

Global Employment Compass

PHILIPPINES

2

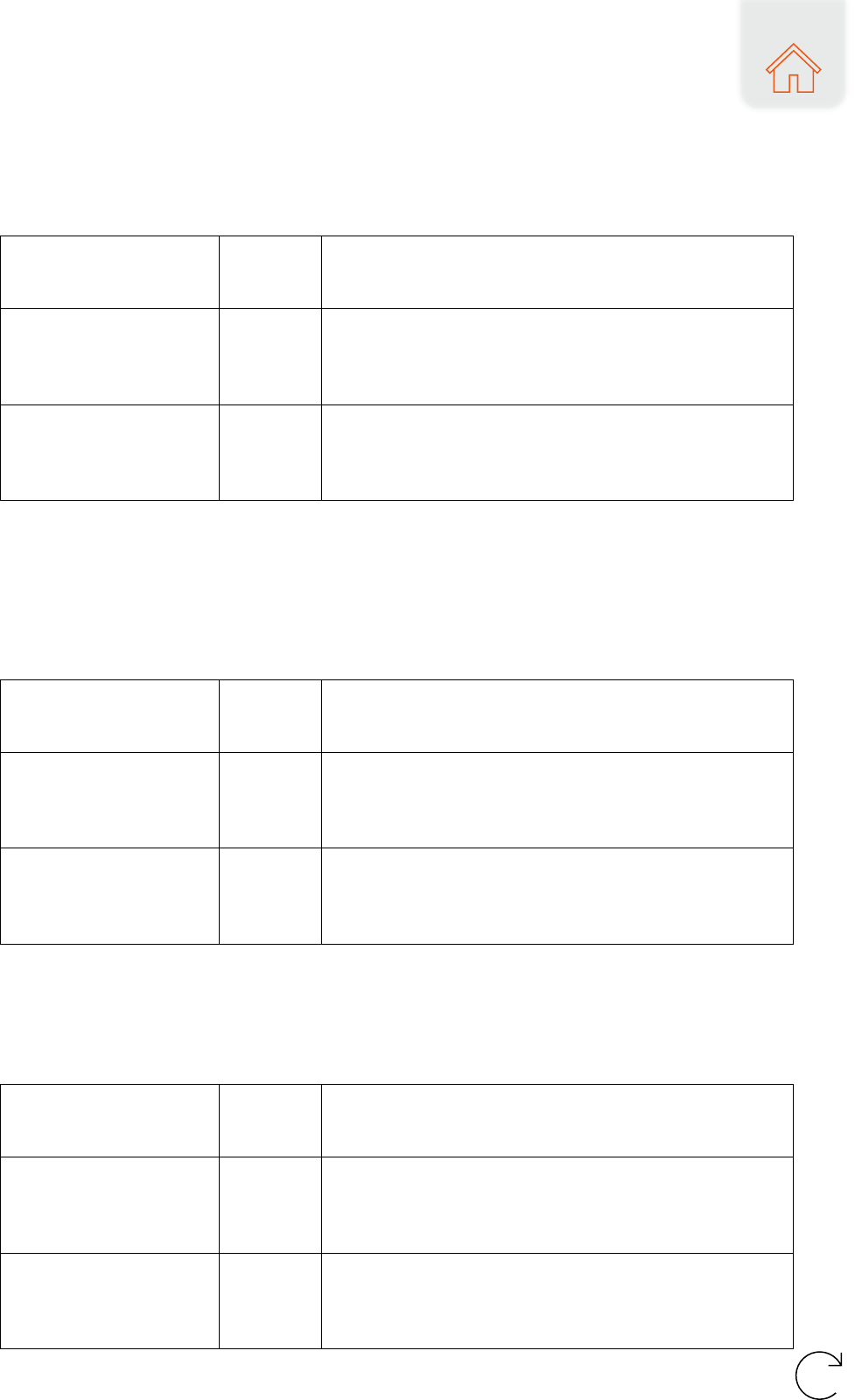

1. Summary of applicable rights

for different categories of workers

Employees

(part-time or full-time)

Independent contractors/

service providers

Volunteers

Employment

laws and

regulations

Yes

No

No

Employees’

compensation/

remuneration

requirements

Yes

No

No

Minimum wage

requirements

Yes

No

No

Mandatory

provident

fund/retirement

benefit fund

contributions

Yes

No

No

Immigration

requirements

including the

right to work in

your country

Yes

Yes

Yes

Personal Data

(Privacy) laws

and regulations

Yes

Yes

Yes

Anti-

discrimination

laws and

regulations

Yes

Yes

Yes

Global Employment Compass

PHILIPPINES

3

2. Legal requirements/rights/

practices for different categories

of workers

a. Employees

Section Contents

1 Contracts of Employment ................................ 3

2 Conditions of employment ............................... 5

3 Safe and supportive work environment ............. 13

4 Tax .............................................................. 15

5 Remote work ................................................. 15

6 What to do when things go wrong? .................. 16

“Employee” includes any person in the employ of an employer. The term shall not be limited

to the employees of a particular employer, unless the Labor Code so explicitly states. It shall

include any individual whose work has ceased as a result of or in connection with any

current labor dispute or because of any unfair labor practice if he has not obtained any other

substantially equivalent and regular employment| (Art. 219 (f), Labor Code).

1 Contracts of Employment

What types of employment contracts are available? E.g. fixed term, part time, zero hour

contracts, other? Are there any specific employment contracts available for non-profit

organizations?

The types of employment contracts are regular, fixed term, project based, seasonal and casual and

probationary employment.

There are no specific employment contracts for non-profit organizations.

What are the key terms of employment contracts?

The employer and the employee may freely stipulate on the terms of employment provided they

are not contrary to laws, morals, good customs, or public policy. Key terms may include among

others the job title and description, salary and benefits, working hours and schedule, leave

entitlements, termination and severance pay, non-disclosure and non-compete clauses.

Global Employment Compass

PHILIPPINES

4

Is it acceptable to have a probation period for employees? If yes, for how long?

Yes, and in general it should not exceed six (6) months from the date the employee started

working, unless it is covered by an apprenticeship agreement stipulating a longer period.

Are fixed term employment contracts permissible? Are there any limitations on fixed

term contracts? Are there any requirements to have a fixed term contract?

Yes, although highly restricted as it can potentially be deemed to deny security of tenure of

employees, fixed-term employment contracts are permitted provided that either of these two

criteria are met:

a. Fixed period was knowingly and voluntarily agreed upon by the parties;

b. It satisfactorily appears that the employer and the employee dealt with each other on more

or less equal terms.

Philippine labor laws do not specify the maximum duration for fixed-term employment contracts.

Nonetheless, the Philippine Supreme Court has recognized the validity of a fixed-term employment

contract with a duration of five years.

Do employment contracts have to be in writing? Are there any signatory requirements

for employment contracts? For example, could they be signed in-person or electronically,

etc.)?

Employment is generally a consensual contract and can be created by mere consent. To prove an

employer-employee relationship, the law does not require an employment contract. However, to

avoid dispute or misunderstanding, it is recommended to provide workers with written employment

contracts stating the terms and conditions of their employment. The written employment contract

can be signed either in-person or electronically. An electronic signature on the electronic document

is equivalent to the signature of a person on a written document if that signature is proved by

showing that a prescribed procedure, not alterable by the parties interested in the electronic

document.

By way of exception, Department of Labor and Employment (DOLE) Department Order No. 174,

series of 2017, requires that contractors and subcontractors provide for a written employment

contract to their deployed personnel to client/s.

Do employees have to be issued with a written employment contract before they start

work?

No, a written employment contract is not required when hiring employees for local employment.

However, in practice, it is strongly recommended to have a written contract because an employee

is presumed to be a regular employee unless there is a written employment contract showing that

he is a non-regular employee, such as probationary, casual, project, seasonal, or fixed-term.

Can you provide a simple template of the contracts mentioned above?

Global Employment Compass

PHILIPPINES

5

There is no standard template contract. It will vary depending on the employer and the type of

employment such as if it is a fixed term, seasonal, project-based or probationary.

Is there an obligation for an employer to run a criminal record check to the extent that

any individual they hire will be working with children or vulnerable people?

There is no such obligation, but background checks are legally permissible in the Philippines and

may be required by an employer prior to hiring an employee as a valid exercise of its management

prerogative.

Can employers request references from former employers for new hires?

Yes, employers can request references from former employers. Former employers are not legally

required to provide the references though. If former employers opt to do so, they should ensure

that the references are true and accurate and in compliance with privacy law as well.

Is an employer required to set up any form of employee representative body? If so, what

is the trigger for this?

No, there is no legal requirement in the Philippines.

Is it common to have collective agreements in your jurisdiction that apply to all

employers in a particular region or sector?

No, it is not common.

2 Conditions of employment

What is the minimum age requirement for employment?

The minimum age for work is 15 years old, except for light work that may be allowed for children

13 to 15 years old, provided it is not hazardous or detrimental to their health, safety, or morals.

There is no definition of light work. Nonetheless, it can be said that light work would be work that

does not involve construction work, logging, fire-fighting, mining, quarrying, blasting, stevedoring,

dock work, deep-sea fishing, mechanized farming, work requiring exposure to power-driven tools,

and other similar activities that are hazardous the minor's safety and health.

What type of work may a child undertake? For example, are there any specific

restrictions?

Children below 15 years old are allowed to engage in light work provided they are directly under

the responsibility of their parents/guardians, and work should not be hazardous or detrimental to

their health, safety, morals, or development.

Children are prohibited from:

Global Employment Compass

PHILIPPINES

6

a. engaging in work which refers to work that is likely to harm the health, safety, or morals of

children. Examples of hazardous work include working in mines, quarries, construction sites,

factories, and other dangerous or risky environments.

b. from working at night.

c. working during school hours and are prohibited from engaging in work that interferes with

their education or prevents them from attending school regularly.

Wages

What is the minimum wage requirement for employees? Are there any exceptions in

minimum wages for young persons or people with disabilities?

The minimum wage in the Philippines varies by sector and region, and is set by law or wage order

issued by the Regional Tripartite Wages and Productivity Boards (RTWPBs).

The current minimum daily wage as of July 2023 for the National Capital Region is (1) Php573.00

to Php610.00 for the non-agricultural sector and (2) Php573.00 for the agricultural sector.

For more information, please refer to this link for the “Summary of Current Regional Daily Minimum

Wage Rates by Region, Non-Agriculture and Agriculture – National Wages and Productivity

Commission (dole.gov.ph)”

There are no exceptions in minimum wage for young persons or persons with disabilities. This is

consistent with relevant Philippine anti-discrimination laws such as the Anti-Age Discrimination in

Employment Act and the Magna Carta for Persons with Disability.

Are there any conditions which warrant a pay raise or extra pay? If yes, what are they?

Philippine labor laws and regulations do not provide for the conditions which will warrant a pay

raise. However, employees are entitled to extra pay if they are required to work (i) overtime (Art.

87, Labor Code), (ii) during their scheduled rest day (Art. 93, Labor Code), (iii) during a holiday

(Arts. 93 & 94, Labor Code), or if they (iv) work at night between ten o’clock in the evening and six

o’clock in the morning (Art. 86, Labor Code).

When are wages due? For example, is there any obligation to pay wages weekly, or

monthly?

Wages are required to be paid every two (2) weeks or twice a month.

The gap between one pay from next should not exceed sixteen (16) calendar days.

There is no legal requirement for an employer to pay on the 15

th

or end of the month. Thus, the

employer may choose whichever days of the month to pay. Thus, depending on whatever is more

practical or convenient, some businesses pay on the 5

th

and 20

th

, 10

th

and end of the month, and

so on.

Are employers obliged to provide employees with paid leave on public holidays?

Global Employment Compass

PHILIPPINES

7

Yes, and this is called a “Holiday Pay”. Holiday pay refers to the payment of the regular daily wage

for any unworked regular holiday.

This benefit applies to all employees except:

1. Government employees;

2. Retail and service establishments regularly employing less than ten (10) workers;

3. Kasambahay (home workers) and persons in the personal service of another;

4. Managerial employees; and

5. Field personnel and other employees whose time and performance is unsupervised by the

employer, including those who are engaged on task/contract basis, purely commission basis or

those who are paid a fixed amount for performing work irrespective of the time consumed.

Are employers obliged to provide employees with annual leave?

No, the entitlement for an annual leave is subject to the agreement between the employer and

employee. But under the Labor Code, every employee who has rendered at least one year of

service is entitled to a yearly service incentive leave of five days with pay.

Service incentive leave entitlement does not apply to among others the following types of

employees:

1. Those with equivalent entitlement from another source;

2. Employees of establishments with less than 10 employees;

3. Government employees;

4. Managerial employees;

5. Field personnel;

6. Domestic helpers or persons in the personal service of another; and

7. Establishments exempted by the Secretary of Labor after considering the viability or

financial condition of such establishment.

Are employees entitled to receive their usual salary during their annual leave?

Yes, unless the leave is already in excess of the allowable leave with pay.

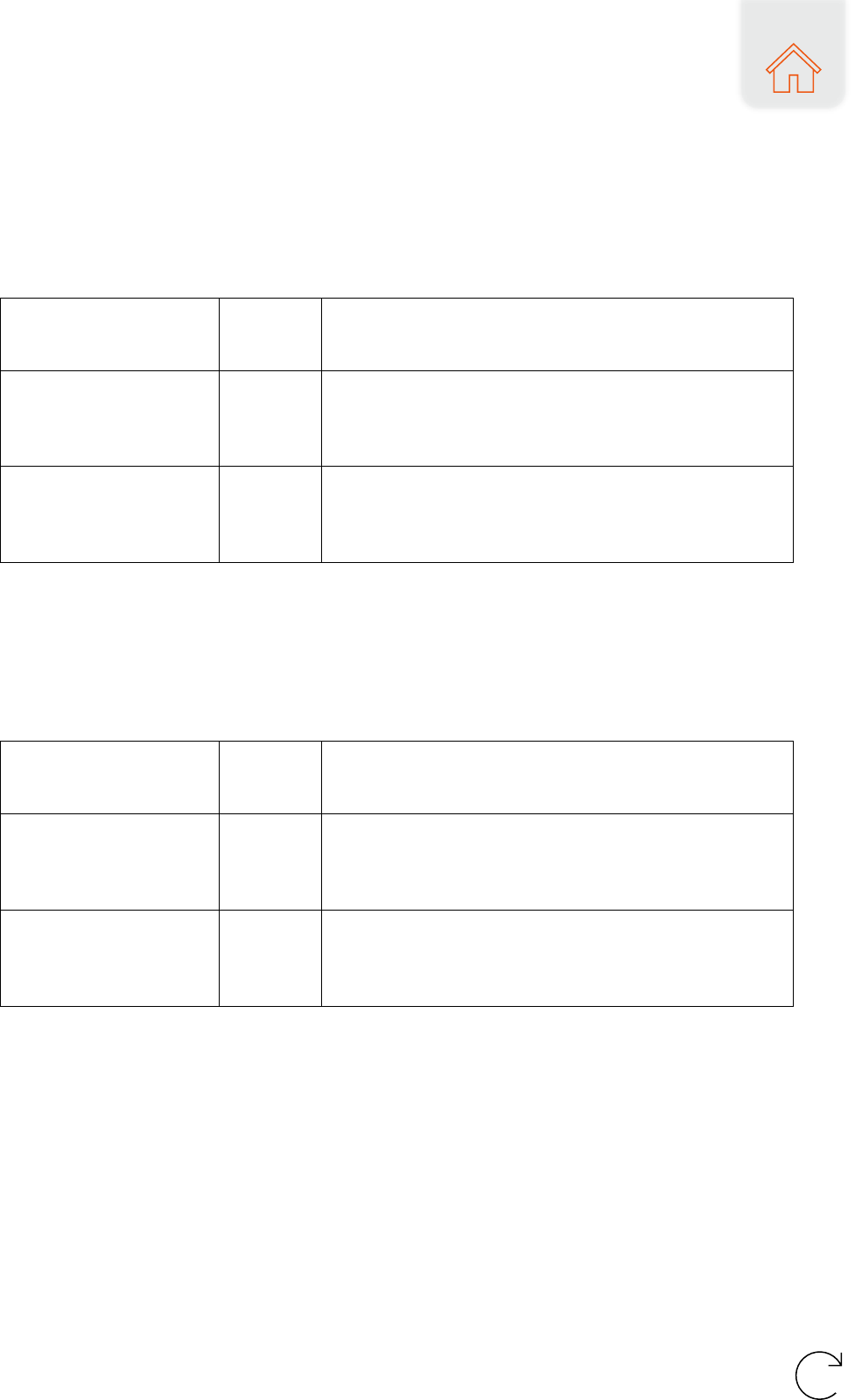

Is there a requirement to pay overtime? How is overtime compensated?

Yes, overtime pay refers to the additional compensation for work performed beyond eight (8) hours

a day. The minimum overtime pay rates vary according to the day the overtime work is performed,

as follows:

Global Employment Compass

PHILIPPINES

8

1. For work in excess of eight (8) hours performed on ordinary working days: Plus 25% of the

hourly rate.

Sector/Industry

Rate

Amount

Non-Agriculture

Php610.00

Php610/8 x 125% = Php76.25 x 125% x number of

hours Overtime (OT) work

Retail/Service

Establishment

Php573.00

₽573/8 x 125% = ₽71.63 x 125% x number of hours OT

work

2. For work in excess of eight (8) hours performed on a scheduled rest day or a special day:

Plus 30% of the hourly rate on said days

Sector/Industry

Rate

Amount

Non-Agriculture

Php610.00

₽610/8 x 130% x 130% = ₽76.25 x 130% x 130% x

number of hours OT work

Retail/Service

Establishment

Php573.00

₽573/8 x 130% x 130% = ₽71.63 x 130% x 130% x

number of hours OT work

3. For work in excess of eight (8) hours performed on a special day which falls on a scheduled

rest day: Plus 30% of the hourly rate on said days.

Sector/Industry

Rate

Amount

Non-Agriculture

Php610.00

₽610/8 x 150% x 130% = ₽76.25 x 150% x 130% x

number of hours OT work

Retail/Service

Establishment

Php573.00

₽573/8 x 150% x 130% = ₽71.63 x 150% x 130% x

number of hours OT work

Global Employment Compass

PHILIPPINES

9

4. For work in excess of eight (8) hours performed on a regular holiday: Plus 30% of the

hourly rate on said days.

Sector/Industry

Rate

Amount

Non-Agriculture

Php610.00

₽610/8 x 200% x 130% = ₽76.25 x 200% x 130% x

number of hours OT work

Retail/Service

Establishment

Php573.00

Not covered by holiday pay rule

5. For work in excess of eight (8) hours performed on a regular holiday which falls on a

scheduled rest day: Plus 30% of the hourly rate on said days.

Sector/Industry

Rate

Amount

Non-Agriculture

Php610.00

₽610/8 x 260% x 130% = ₽76.25 x 260% x 130% x

number of hours OT work

Retail/Service

Establishment

Php573.00

Not covered by holiday pay rule

Are there any extraordinary circumstances that could be relied on to temporarily cease

paying employees for the hours worked?

None.

Are employees entitled to an end-of-year payment?

Yes, and it is referred to as the “13

th

Month Pay”. The 13

th

Month Pay is equivalent to one-twelfth

of the total basic salary earned by an employee within a calendar year.

Global Employment Compass

PHILIPPINES

10

Are employees entitled to payments when their employment contract is terminated, such

as notice or notice pay, accrued or untaken holiday and/or statutory severance?

Yes, and it is called “Separation Pay”, which is a compensation given to an employee who is

terminated from employment due to authorized causes provided in Articles 298 and 299 of the

Labor Code. However, employees terminated from employment based on just causes (i.e. due to

employees’ misconduct/fault) under Article 297 of the Labor Code are not entitled to separation

pay.

Working hours

What is considered a full time working week? If the employee is contractually required

to work less than this amount are they considered a part time employee?

The prescribed workweek for the private sector is 48 hours which translates to a 6-day workweek

at 8 hours per day, and applies only to rank-and-file employees and excludes managerial

employees and managerial staff.

The prescribed workweek for the government sector is 40 hours which is a 5-day workweek at 8

hours per day.

The normal hours of work must not exceed eight (8) hours a day, exclusive of the one (1) hour

daily lunch break. Philippine laws, however, do not prohibit work done for less than eight hours.

Part-time work is allowed and the pay will correspond to the actual hours worked.

Are there fixed public/statutory holidays each year? Can employees be required to work

on public/statutory holidays? Are employees entitled to any other type of leave besides

public/statutory holidays?

Yes, there are 11 regular holidays and 3 special holidays for each year in the Philippines.

Employees can be required to work during holidays subject to the payment of the prescribed

holiday pay/premium.

Employees who have rendered at least one year of service are entitled to a yearly service incentive

leave of five (5) days with pay. Moreover, there are other leaves provided under relevant

Philippine laws and these are:

• Parental leave of 7 working days every year granted to solo parent employee who has

rendered at least one year of service;

• Battered woman leave of 10 days granted to victims of violence against women which is

penalized under the Anti-violence Against Women and Their Children Act of 2004;

• Special leave consisting of two months granted to women after a surgery caused by

gynecological disorders;

• Paternity leave of seven calendar days; and

• Maternity leave of 105 days.

Global Employment Compass

PHILIPPINES

11

Do part time employees receive any particular protection on the basis of their part-time

status?

A regular employee may be a full-time regular or a part-time regular. Part-time employees enjoy

security of tenure so they may only be terminated from employment based on causes provided

under the Labor Code and after observance of due process.

Do part-time employees receive the same pro-rated terms to full time employees, e.g. in

relation to pay and benefits?

Yes, when it comes to the wage and benefits of part-time workers, they should be in proportion to

the number of hours worked.

As the Labor Code benefits are generally based on the 8-hour workday schedule, the employer may

proportionately decrease the daily wage and wage-related benefits granted by law. This

presupposes that there is no contrary stipulation in the employment contract, company policy,

collective bargaining agreement, requiring full payment for 8 hours a day despite a shorter work

schedule.

Social security

What social security contributions are employers obliged to pay? Presumably, pro-rated

contributions are required for part time employees?

Employers are required to pay the employers’ share in social security contributions for their

employees to the Social Security System, Philippine Health Insurance Corporation, and Home

Development Mutual Fund.

The amount or rate of social contributions depends on the amount of the employee’s income,

rather than whether the employee is full-time or part-time.

Are employers obliged to provide health insurance to their employees?

Employers are not required to provide private health insurance coverage to their employees.

However, the employers are obliged by law to enroll their employees to the Philippine Health

Insurance Corporation (PhilHealth), which provide health insurance benefits to members, and

pay/remit the employers’ contribution together with the employees’ contribution to the PhilHealth.

Are employees entitled to unemployment insurance/benefits following the end of

employment?

Employees in the private sector are required by law to be enrolled in the Social Security System

(SSS) that provides social security insurance benefits to members. Employers remit both its and

their employees’ share in the contributions to the SSS. One of the benefits under the SSS is the

unemployment benefit or insurance of up to a maximum of Php10,000.00 per month, that can be

availed by an SSS member with at least 36 monthly contributions, and with at least 12 months of

contributions remitted for the last 18 months preceding the involuntary unemployment or

separation.

Global Employment Compass

PHILIPPINES

12

Are employers obliged to provide sick leave? If yes, for how long? How many days have

to be paid by employers? Is it possible to have unpaid sick leave?

No, there is no law that requires employers to provide sick leave to employees. Grant of sick leave

depends on voluntary employer policy or collective bargaining between the employer and

employees.

Are employers obliged to provide maternity leave for employees? If yes, for how long?

How many days/months have to be paid by employers? Is it possible to have unpaid

maternity leave?

Yes, employers are obliged to provide all pregnant female employees, whether single or married,

maternity leave with full pay to be used in every instance of pregnancy, miscarriage or emergency

termination of pregnancy. In cases of live childbirth, the benefit consists of 105 days maternity

leave with full pay and an option to extend for an additional 30 days without pay. If a qualified solo

parent, the female employee is granted an additional 15 days of maternity leave with full pay. In

cases of miscarriage or emergency termination of pregnancy, 60 days maternity leave shall be

granted.

The female employee entitled to maternity leave may, at her option, allocate seven (7) days of

maternity leave credits to the child’s father, whether or not he is married to the female employee.

In case of death, absence, or incapacity of the father, the benefit may be allocated to an alternate

caregiver who may be a relative within the fourth degree of consanguinity or the current partner of

the female employee sharing the same household.

No, it is not possible to have unpaid maternity leave, except in the case of the optional extended

maternity leave of 30 days which is without pay.

Is paternity leave available to employees? If yes, for how long? How many days/months

have to be paid by employers? Is it possible to have unpaid paternity leave?

Yes, paternity leave benefits are given to married male employees whose legal wife underwent

delivery or miscarriage. The benefit applies to all male employees regardless of employment

status. The benefit consists of seven (7) calendar days of leave credits with full pay. The benefit

applies to the first four (4) deliveries of the male employee’s legal wife, with whom he is

cohabiting.

No, it is not possible to have unpaid paternity leave.

Are employers liable for absence due to work-place injuries?

Yes, in the event of work-related sickness, injury or death, employees (whether in the public or

private sector) or their dependents are entitled to receive benefits under the Employees’

Compensation Program of the government. Under this program, the employer shall register the

employee in the Social Security System (SSS) for private sector employees or the Government

Service Insurance System (GSIS) for public sector employees.

Global Employment Compass

PHILIPPINES

13

Are employees entitled to retirement benefits from the employer? If yes, what benefits?

Yes, in the absence of a retirement plan or agreement providing for retirement benefits of

employees with the employer, an employee upon reaching the age of 60 years or more, but not

beyond 65 years (which is the compulsory retirement age) who has served at least five (5) years

with the employer, may retire and shall be entitled to retirement pay equivalent to at least one-half

(1/2) month salary for every year of service (Art. 286, Labor Code).

Are employers obliged to introduce reporting channels and legal safeguards for

whistleblowers?

No, employers are not legally required to introduce reporting channels and legal safeguards for

whistleblowers. However, the Revised Corporation Code of the Philippines (the “Code”) provides

that any person who, knowingly and with intent to retaliate, commits acts detrimental to

a whistleblower (i.e. any person who provides truthful information relating to the commission or

possible commission of any offense or violation under the Code ) such as interfering with the lawful

employment or livelihood of the whistleblower, shall, at the discretion of the court, be punished

with a fine not exceeding Php1,000,000.00. Moreover, the Labor Code mandates that it shall be

unlawful for an employer to refuse to pay or reduce the wages and benefits, discharge or in any

manner discriminate against any employee who has filed any complaint or instituted any

proceeding concerning wages or has testified or is about to testify in such proceedings.|

3 Safe and supportive work environment

Broadly what measures have to be in place to ensure employers uphold health and

safety? (such as fire or earthquake drills)

Employers are required to comply with occupational safety and health standards as provided in the

Occupational Safety and Health Standards Act (i.e., Republic Act No. 11058) including informing

workers on all types of hazards in the workplace and having the right to refuse unsafe work, as

well as providing facilities and personal protective equipment for the workers, among others.

Is there a requirement for an employer to issue any form of non-discrimination policies?

(such as gender equality policies, equal employment opportunities, diversity, and

inclusion policies, etc.)

There are various anti-discrimination laws in the Philippines that prohibit discriminatory acts

relating to employment on account of disability, age, pregnancy and maternity, race, sex, or

religion or belief. These laws include the following:

1. Article 135 of the Labor Code, which prohibits discrimination against any woman employee

with respect to terms and conditions of employment solely on account of her sex;

2. The Magna Carta of Women which prohibits discrimination against women;

3. The 105-Day Expanded Maternity Leave Law which prohibits discrimination against the

employment of women in order to avoid maternity leave benefits;

Global Employment Compass

PHILIPPINES

14

4. The Anti-Sexual Harassment Act of 1995 which declares unlawful all forms of sexual

harassment in the employment, education or training environment;

5. The Safe Spaces Act, which penalizes the crime of gender-based sexual harassment in the

workplace;

6. The Solo Parents’ Welfare Act of 2000, prohibiting an employer to discriminate against any

solo parent employee with respect to terms and conditions of employment on account of

his/her status;

7. The Anti-Age Discrimination in Employment Act which prohibits discrimination in

employment on account of age;

8. The Magna Carta for Persons with Disability which prohibits discrimination against a

qualified disabled person by reason of disability in regard to job application procedures,

hiring, promotion, or discharge of employees, employee compensation, job training, and

other terms, conditions, and privileges of employment; and

9. The Indigenous Peoples’ Rights Act of 1997 which penalizes discrimination against any

indigenous cultural communities/indigenous peoples with respect to the terms and

conditions of employment on account of their descent.

Generally, there is no legal requirement for employers to issue any form of non-discrimination

policies. The exceptions will be the requirement for such policies or rules and regulations with

respect to sexual harassment as provided under the Sexual Harassment Act of 1995 and gender-

based sexual harassment as mandated under the Safe Spaces Act.

Is there a requirement to provide employees with training designed to combat

discrimination and harassment?

Generally, there is no legal requirement to provide employees with training designed to combat

discrimination and harassment. There are instances though that requires the training of employees,

and these are:

a. The Sexual Harassment Act of 1995’s requirement on employers (i) to promulgate

appropriate rules and regulations, in consultation with and jointly approved by the employees,

prescribing the procedure for the investigation of sexual harassment cases and the

administrative sanctions for them, including guidelines on proper decorum in the workplace;

(ii) to create a committee on decorum and investigation of cases on sexual harassment and

such committee shall conduct meetings with officers and employees to increase understanding

and prevent incidents of sexual harassment; and (iii) to disseminate or post a copy of the law

for the information of all concerned.

b. The Safe Spaces Act’s requirement on employers (i) to disseminate or post in a

conspicuous place a copy of the law to all persons in the workplace; (ii) to provide measures

to prevent gender-based sexual harassment in the workplace, such as the conduct of anti-

sexual harassment seminars; (iii) to create an independent internal mechanism or a

committee on decorum and investigation to investigate and address complaints of gender-

based sexual harassment; and (iv) to provide and disseminate, in consultation with all persons

in the workplace, a code of conduct or workplace policy which shall expressly reiterate the

prohibition on gender-based sexual harassment, describe the procedures of the internal

mechanism created under the law, and set administrative penalties.

Global Employment Compass

PHILIPPINES

15

Is there a requirement to have a data protection policy?

Yes, the Data Privacy Act of 2012 requires personal information controller, such as an employer, to

implement reasonable and appropriate organizational, physical and technical measures intended for

the protection of personal information against any accidental or unlawful destruction, alteration and

disclosure, as well as against any other unlawful processing. Included in these measures is the

presence of a security policy.

Is it mandatory for employers to have a Child Protection Policy (CPP)? Are employees

obliged to provide training on CPP to its employees?

No, there is no legal requirement for employers to have Child Protection Policy (CPP) nor are they

required to provide CPP training to its employees.

4 Tax

Which taxes are mandatory for employers to pay and deduct on behalf of their

employees?

Employers are legally required to withhold income tax due on employees’ income (i.e., salary,

bonus etc.) received from the employers and remit the withheld tax to the Bureau of Internal

Revenue (BIR), the Philippine tax authority.

Are all employee taxes deducted from the salary that the employer pays or is there a

requirement for employees to pay certain taxes directly?

All the income tax due on income received by the employees from employers are subject to

withholding and remittance to the BIR by the employers.

5 Remote work

Are employers required to have a registered legal entity in the jurisdiction in order to

employ employees in the jurisdiction?

No, there is no legal requirement to have a registered legal entity in the Philippines to employ

employees in this country. However, considering that there are certain registration, filing,

reporting, and social security contributions for employees to be made by employers to relevant

government agencies, it would be practical for employers to have a registered legal entity.

Are employers required to provide any form of physical working space for employees

working in your country?

No, employers are not required to provide any form of physical working space for employees

working in the Philippines. In fact, the Telecommuting Act authorizes telecommuting which is a

Global Employment Compass

PHILIPPINES

16

work arrangement that allows an employee to work from an alternative workplace. An alternative

workplace is any location where work, through the use of telecommunication and/or computer

technology, is performed at a location away from the principal place of business of the employer,

including but not limited to the employee’s residence, co-working spaces, or other spaces that

allow for mobile working. The terms and conditions of telecommuting shall not be less than the

minimum labor standards.

Please provide general instructions for employers on what to check if the employer has

remote employees, including concerning employee tax liabilities.

Employers offering telecommuting program to employees should comply with the requirements of

the Telecommuting Act which requires that the telecommuting program (1) be on voluntary basis,

(2) have terms and conditions that are not less than the minimum labor standards, (3) adhere to

and be guided by the mutually agreed policy or telecommuting agreement, (4) ensure same

treatment between telecommuting employees and those working at the employer’s premises, and

(5) have appropriate measures to ensure the protection of data used and processed by the

telecommuting employee for professional purposes.

Additionally, employers that have remote employees working in the Philippines should also check

on withholding tax obligations, risk of creating tax presence in the Philippines through remote

employees, and requirement to make social security contributions for the remote employees.

6 What to do when things go wrong

Dispute resolution

Do employees (including volunteers) need to go through any form of dispute resolution

before bringing a claim to a court or tribunal?

No, unless there is a contractual obligation to do so.

Resignation

What grounds do employees have for resignation?

Resignation is defined as “the voluntary act of an employee who is in a situation where one

believes that personal reasons cannot be sacrificed in favor of the exigency of the service, and one

has no other choice but to dissociate oneself from employment.” An employee may terminate

without just cause the employee-employer relationship by serving a written notice on the employer

at least one (1) month in advance. The employer upon whom no such notice was served may hold

the employee liable for damages. An employee can change their mind by withdrawing their

resignation. But if the resignation has already been accepted or approved by the employer, the

withdrawal of the resignation will require the employer's consent.

An employee may put an end to the relationship without serving any notice on the employer for

any of the following just causes: a) serious insult by the employer or his representative on the

Global Employment Compass

PHILIPPINES

17

honor and person of the employee; b) inhuman and unbearable treatment accorded the employee

by the employer or his representative; c) commission of a crime or offense by the employer or his

representative against the person of the employee or any of the immediate members of his family;

and d) other causes analogous to any of the foregoing.

Currently, no implementing rules or court decisions provide further details or examples about

definition of serious insult on the honor. Nonetheless, possible examples would be

libelous/defamatory remarks or actions towards the employee or other serious insulting acts

tending to demean the employee's honor and person.

At the same time, we believe that non-payment of salary on time may be a sufficient ground for

resigning without prior notice.

Termination

What grounds do employers have for the termination of employment contracts?

The employers may terminate employment for just causes or authorized causes.

Just causes of termination refer to serious misconduct, willful disobedience or insubordination,

gross and habitual neglect of duties, fraud or willful breach of trust, loss of confidence, commission

of a crime or offense, and analogous causes. For acts or omissions to be considered as analogous

causes, the same must be an employee’s actions, behavior, or omission, either of which resulted in

a serious or grave violation of the law, employment contract, company policies, collective

bargaining agreement, and any other employment agreement.

Authorized causes of termination refer to installation of labor-saving devices, redundancy,

retrenchment or downsizing, closure or cessation of operation, and disease.

How do employers have to document the termination of an employment contract?

For termination based on just causes, the employer has the burden of proving that a dismissed

worker has been served two notices:

• First written notice: specifying the ground(s) for termination and giving the employee the

reasonable opportunity within which to explain his side. Reasonable opportunity should be

construed at least 5 calendar days from receipt of the notice.

• Second written notice: indicating that upon due consideration of all circumstances, grounds

have been established to justify his termination.

The twin notice requirement is to give the employee an opportunity to study the accusation against

him, consult a union official or lawyer, gather data and evidence, and decide on his/her defenses.

There must also be a hearing or conference during which the employee concerned, with the

assistance of counsel if they so desire, is given the opportunity to respond to the charge, present

their evidence, or rebut the evidence presented against him/her.

For termination based on authorized causes, the employer is required to serve written notice to the

employee and to the Department of Labor and Employment at least 30 days before the effectivity

of the termination of employment.

Global Employment Compass

PHILIPPINES

18

What is the responsibility of employers for damages incurred by an employee’s actions

within his/her work?

Employers shall be liable for the damages caused by their employees and household helpers, acting

within the scope of their assigned tasks, even though the former are not engaged in any business

or industry.

Global Employment Compass

PHILIPPINES

19

b. Independent contractors/consultants*

Section Contents

1 Contracts ...................................................... 19

2 Conditions of work for consultants .................... 20

3 Safe and supportive work environment ............. 22

4 Remote work ................................................. 23

5 What to do when things go wrong .................... 23

“Contractor” refers to any person or entity engaged in a legitimate contracting or subcontracting

arrangement providing services for a specific job or undertaking farmed out by principal under a

service agreement (Section 3, d), DOLE Department Order No. 174, series of 2017).

* The term consultant will be used to also refer to independent contractors, or any other term that

would mean a person that provides goods or services under a written contract or a verbal

agreement but does not work to meet the definition of employee.

1 Contracts

What types of independent contractor/consultant agreements are available? Are there

any specific agreements available to NGOs?

To be considered an independent contractor, the individual must possess unique skills and talents

which set them apart from ordinary employees and whose means and methods of work are free

from the control of the employer. It is governed by a bilateral relationship because the independent

contractors are directly engaged by the principal. There is no specific agreement applicable to

NGOs.

What are the main elements of consultant agreements?

The service agreement between the principal and independent contractor must include the

following: a) the specific description of the job or work being farmed out including its term or

duration; b) place of work and terms and conditions of contracting arrangement to include the

agreed amount of the contracted job or work as well as the standard administrative fee of not less

than 10% of the total contract cost; and c) provision on the issuance of bond/s equal to the cost of

labor under the contract renewable every year.

Is it possible to have probation periods for independent contractors/consultants? If yes,

for how long?

No, it is not possible to have probation periods.

Global Employment Compass

PHILIPPINES

20

Is it possible to have a fixed term consultation/independent contractor agreement? Are

there any restrictions around fixed term consultant/independent contractor

agreements?

Yes, it is possible to have fixed-term independent contractor agreement. There are no restrictions,

but it is advisable that the duration of the agreement ends with the completion of the specific

project or undertaking.

Do independent contractor/consultant agreements have to be in writing? Are there any

signatory requirements? For example, could they be signed in-person or electronically,

etc.)?

It must be in writing, signed by both parties, either in-person or electronically. An electronic

signature on the electronic document is equivalent to the signature of a person on a written

document if that signature is proved by showing that a prescribed procedure, not alterable by the

parties interested in the electronic document.

Do all types of independent contractors/consultants have to be under contract in order

to be able to work?

Yes. There is a required contract and stipulations to be contained therein. (See b.1.1.2 above)

Can you provide a simple template of the agreements mentioned above? Is there an

obligation to run a criminal record check to the extent that any independent contractor

will be working with children or vulnerable people?

There is no universal template service agreement for independent contractors since its terms are

determined by the agreement of the parties. What is important though is for the service agreement

to contain the main elements listed above.

There is no obligation to run a criminal record check, but most companies request applicants to

submit clearance from the Philippine National Bureau of Investigation or Philippine National Police

as a pre-screening requirement.

2 Conditions of work for consultants

Are there any minimum age requirements for an individual to work under a

consultant/independent contractor agreement?

A person who has reached the age of majority (i.e., 18 years old) is legally qualified for all acts of

civil life, including entering into contracts.

Does a consultant/independent contractor need to obtain a license or any other

permission in order to work?

No license is required for independent contractors.

Global Employment Compass

PHILIPPINES

21

Payment

Are there any minimum pay requirements for consultants/independent contractors? Are

there any exceptions in minimum wages for young persons or people with disabilities?

None. Payment made to the independent contractor is the compensation agreed upon in the

contract.

Is there any requirement to provide statutory/paid leave to consultants for statutory

holidays?

None, unless otherwise stipulated in the contract.

Is there any requirement to pay annual leave to consultant/independent contractors? If

so, how is this compensated, if at all?

None, unless otherwise stipulated in the contract.

Is there an obligation to provide consultant/independent contractors with overtime?

How is this compensated if required?

None, unless otherwise stipulated in the contract.

Are consultants entitled to an end-of-year payment?

None, unless otherwise stipulated in the contract.

Are consultants entitled to a final payment when the contract is terminated?

None, unless otherwise stipulated in the contract.

Working hours

Are consultants entitled to any type of leave, whether paid or unpaid?

None, unless otherwise stipulated in the contract.

Social security

Does the end user engager need to make any social security contributions on behalf of a

consultant/independent contractor? Are independent contractors entitled to health

insurance from the end user engager?

Global Employment Compass

PHILIPPINES

22

No. Independent contractors shall pay their own contributions to social security, health insurance,

etc.

Are independent contractors/consultants entitled to unemployment insurance/

benefits after termination of their independent contractor/consultancy agreement from

the end user engager?

None, unless otherwise stipulated in the contract.

Are independent contractors/consultants entitled to sick leave from the end user

engager? If yes, for how long? How many days have to be paid?

None, unless otherwise stipulated in the contract.

Are independent contractors/consultants entitled to maternity leave from the end user

engager? If yes, for how long? How many days/months have to be paid?

None, unless otherwise stipulated in the contract.

Are independent contractors/consultants entitled to paternity leave from the end user

engager? If yes, for how long? How many days/months should be paid?

None, unless otherwise stipulated in the contract.

Are employers obliged to cover work-place injuries for independent

contractors/consultants?

No, unless there are contractual stipulations providing for coverage.

Are independent contractors/consultants entitled to retirement benefits from the end

user? If yes, what benefits?

None, unless otherwise stipulated in the contract.

3 Safe and supportive work environment

Are there any differences in terms of the regime that applies to employees?

The Occupational Safety and Health Standards Act (i.e., Republic Act No. 11058) applies to all

“covered workplaces” - establishments, projects, sites and all other places where work is being

undertaken. The law also defines “employer” as referring to any person, natural or juridical,

including the principal employer, contractor or subcontractor, if any, who directly or indirectly

Global Employment Compass

PHILIPPINES

23

benefits from the services of the employee. Consequently, the occupational and health standards

prescribed under the law covers independent contractors and consultants as well.

4 Remote work

Are end user engagers required to have a registered legal entity in the jurisdiction in

order to hire independent contractors/consultants there?

No. But the end user engager / principal needs to register with the Philippine Bureau of Internal

Revenue as it is required to withhold and remit the tax on income payments to independent

contractor.

The independent contractor is liable to pay the taxes due on income received from the engager.

However, existing tax law also requires the engager/income payor to withhold a creditable

withholding tax on income payments to contractors. The amount of withheld tax will be creditable

against the contractor income tax payments to the Philippine tax authority.

5 What to do when things go wrong

Resignation

Do consultants/independent contractors need a reason to terminate the contract or can

they terminate it for any reason in accordance with the terms of the contract?

They can terminate for reasons found in the contract.

Termination of agreement

What grounds do end user engagers have for the termination of consultant agreements?

The principal and independent contractor may include in their contract the valid reasons and

procedure for terminating the contract between them. They can also agree to terminate the

contract at any time. However, if they do not include any valid reason or procedure for terminating

the contract and the parties do not agree to terminate the contract, then the contract can only be

terminated by filing a case in court.

What is the responsibility of the end user engagers for damages incurred by a

consultant’s actions within his/her work?

End user engagers’ responsibility will depend on the contractual stipulations. It is also possible for

end user engagers to be liable under the vicarious liability doctrine, if they will be deemed as

responsible for the independent contractor within their work. It must be noted though that

vicarious liability is usually imposed on employers with respect to their employees.

Global Employment Compass

PHILIPPINES

24

c. Volunteers

Section Contents

1 Contracts ...................................................... 24

2 Conditions of employment ............................... 24

3 Safe and supportive work environment ............. 25

4 Tax .............................................................. 25

5 What to do when things go wrong .................... 26

There is no definition of “volunteer” under the law.

1 Contracts

Are organizations required to sign any form of agreement with volunteers?

There is no legal requirement to sign any form of agreement with volunteers.

2 Conditions of employment

Is there a minimum age requirement for volunteers?

None.

What type of volunteering work may a child undertake? Are there any restrictions

around this?

There is no specific requirement in the Philippines. Nonetheless, it is needless to state that the

volunteering work should not have a negative impact on the health, safety and well-being of the

child.

Payments and reimbursement

Are organizations allowed to pay stipends to volunteers?

Yes, organizations are allowed to pay stipends to volunteers. However, the amount must be

reasonable to avoid the risk of the stipend being deemed as a wage that can potentially attract risk

of the existence of employer-employee relationship.

Are organizations allowed to reimburse volunteers? If yes, for what expenses (such as

transportation, food, etc.).

Global Employment Compass

PHILIPPINES

25

Yes, organizations are allowed to reimburse volunteers for reasonable expenses incurred in

rendering voluntary work.

Working hours

Are there any obligations around how many hours volunteers can work?

None.

Are volunteers entitled to any type of leave?

No.

Social security

Are organizations obliged to pay any social security contributions on behalf of their

volunteers?

No.

Are organizations obliged to provide health insurance to volunteers?

No.

Are organizations liable for absences of volunteers due to work-place injuries?

No.

3 Safe and supportive work environment

Are there any differences in terms of the regime that applies to employees?

Just like in the case of employees, volunteers’ health and safety should be considered as well.

4 Tax

Are organizations obliged to pay taxes if they pay their volunteers stipends? If yes, what

types of taxes are mandatory to pay?

No, organizations are not obliged to pay taxes on volunteers’ stipends.

Global Employment Compass

PHILIPPINES

26

5 What to do when things go wrong

What grounds do organizations have for the termination of volunteer

agreements/arrangements?

There are no specified grounds under the law for termination of volunteer agreements. The written

agreement, if any, may provide for such grounds though.

What is the responsibility of organizations for damages incurred by a volunteer’s actions

within his/her work?

The organization may be contractually liable for damages resulting from a volunteer’s actions (i.e.,

fault or negligence) within their work if such is provided for in the volunteering agreement. It is

also possible for organizations to be liable under the vicarious liability doctrine, if the organization

will be deemed as responsible for the volunteers within their work. It must be noted though that

vicarious liability is usually imposed on employers with respect to their employees.

Global Employment Compass

PHILIPPINES

27

d. Non-citizen employees and

consultants, including refugees and

others forcibly displaced

Section Contents

1 Status and the right to work ............................ 27

2 Contracts ...................................................... 28

3 Conditions of employment ............................... 28

4 Safe and supportive work environment ............. 28

5 What to do when things go wrong? .................. 28

1 Status and the right to work

Are employers obliged to secure legal status for their employees or consultants if they

are non-citizens? (such as refugee status, humanitarian visas, visas for trafficking

survivors, other recognized protection statuses, etc.)

To be employed in the Philippines, non-citizen or alien employees are required to obtain an Alien

Employment Permit (AEP) and work visa in the country. Hence, employers are required to ensure

that their non-citizen or alien employees have these documents.

Are employers obliged to secure work permits for their employees or consultants? Is it

always necessary to obtain a work permit?

Yes, all foreign nationals who intend to engage in gainful employment in the Philippines are

required to have an AEP. However, some foreigners are exempt from the AEP requirement such as

members of the diplomatic service, officers and staff of international organizations, elected

members of a governing board who do not occupy any other position, and refugees and stateless

persons recognized by the Department of Justice pursuant to Article 17 of the UN Convention and

Protocol Relating to Status of Refugees and Stateless Persons.

The Labor Code provides that the AEP may be issued after a determination of the nonavailability of

a person in the Philippines who is competent, able and willing at the time of AEP application to

perform the services for which the alien employee is desired.

Can asylum-seekers and other persons forcibly displaced access the right to work if they

do not have refugee status or other recognized protection statuses?

No.

Global Employment Compass

PHILIPPINES

28

2 Contracts

Are employment contracts or consultant agreements for non-citizens different to those

for citizens?

No.

3 Conditions of employment

Does national law regulate the quotas for the number of non-citizens within one

organization? Are employers obliged to report about employed non-citizens?

No, Philippine law does not regulate the quotas for the number of non-citizens within an

organization. However, the AEP, which is required for employment, is issued after a determination

of the nonavailability of a person in the Philippines who is competent, able and willing at the time

of AEP application to perform the services for which the alien employee is desired. Employees are

required to report about their employees, whether citizens or non-citizens.

Are there any other differences in conditions of employment for non-citizens and

citizens?

None.

Are there any specific employment terms that apply to citizens but not apply to

non-citizens?

None, save for the requirement for work visa and AEP.

4 Safe and supportive work environment

Are there any differences in a safe and supportive work environment approach for non-

citizens? If yes, please elaborate here.

None.

Does the employer have additional obligations for non-citizens?

None, except for the requirement that it must ensure that the non-citizen employees have the AEP

and work visa.

5 What to do when things go wrong

Is the process of termination of an employment contract for non-citizens different than

for citizens? If yes, please explain here.